Volex Preliminary Results - My Take

Volex - Growth & Margin Expansion & they want you to know about it!

Needless to say, nothing here or in any other part of this blog should be considered investment (or any other form of) advice.

So, encouraged by my sharing this blog on twitter and the 8 to 10 visitors I have had since (pretty sure most of them are me), I thought I would add my thoughts on a company that reported its preliminary results today.

As you may have guessed from the title, the company's name is Volex, which I hold.

At this point, I would like to make clear that I don't really come up with detailed valuation models but rather apply some common sense to the business activities performance & narrative to come up with where I think the business will be.

I often end up not very far from analysts, which is not my genius or analyst stupidity, but rather in my view a function of the finance industry unnecessarily complicating things at times.

Anyway, with the excuses out of the way and expectations duly managed, here goes.

Summary

Strong results with growth in data centers and electric vehicles driving revenue growth in the year.

Expect performance to continue based on recovery in Industrial (ex Data Centers) & Medical + growth from acquisitions.

Key concern is the margin pressure (earlier reduction in holding because of this offset by trading update where the growth in EVs was not fully appreciated), but the growth, production enhancements, organisational learning & capacity should hopefully help margin expansion over the medium term.

Management are aware and focused on this issue.

The results have been presented in a very favourable light and the underlying performance in the legacy business as it were is not as strong.

From a valuation perspective, I think the 2024 results are likely achievable and potentially some upside surprise to the Revenue forecasts.

The business is currently on EV to EBIT multiple of 20x

Given my view on 2024, I would argue that for the valuation to make sense, you need the current multiples to be sustained. A 20% drop in the multiple would result in paying today's price for 2024 results and given the dilution from share options, the dilution risk is there, even if not multiple contraction.

This is not unique to this company - in my view there is a lot of faith in peak multiples being maintained, even after the growth starts to slow.

Investment Thesis

- Market leadership and low cost operator in critical components and exposure to some exciting structural growth industries with R&D focused in these areas and recovery potential in the "incumbent" less sexy areas.

- Management have been moving up the value chain in complex assemblies, acquisitions to expand geography and vertically integrate, the aim of which is to move into higher margin products and enhance operating margins.

- High levels of insider ownership and business successfully executed turnaround and now into a more stable growth phase with a disciplined acquisition strategy - they alluded to the high cost and not being willing to transact.

- Management intensely focused on managing margins through process improvements, improving the product and working with customers to deliver improvements & seem to have been effective in capital allocation (eg EVs & North America)

- Turnaround & higher value strategy is reflected in improving margins and returns on capital

- Acquisitions at 10% of revenue growth is not aggressive deal seeking

- Key short term risk are in the form of margin pressure high levels of dilution and the need for multiples to be maintained.

- Further, potential for trade tariffs / reshoring of supply chains could put the business under pressure (although may also be an opportunity) given DEKA acquisition and Batnam expansion - production can be moved.

Investment Decision

Hold

Given the current valuation and margin uncertainty I don't think it is sensible to add, especially given execution risks in an acquisition led strategy and emerging competition.

High levels of growth may well offset any margin pressure.

If margins are held, over the next year, it could move to add, but at the moment or if growth surprises to the upside, the latter is more possible in my view than margin maintenance.

There was some discussion around the deferred tax credit - in defence of management, for those willing to read the EPS impact of this credit is clearly stated, however, I agree with the general view that there has been an effort to present this in a more favorable light.

It is a positive sign that tax losses that didn't previously meet recognition criteria now do meet the criteria.

There is longer term growth potential and it may in the longer term end up in a similar sort of place to Diploma, but decisions on that can only be made based on information on progress of the business.

What do they do

Volex plc is a supplier of power cords and cable assembly solutions servicing a range of markets, including consumer electronics, telecommunications, data centers, medical equipment and the automotive industry.

The business generates revenues in North America, Europe & Asia, operating in 4 divisions being:

Medical, Consumer Electricals, Industrial Technology & Electric Vehicles.

Results Overview

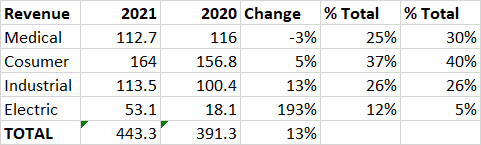

For the year ended 31 March 2021, they generated revenues of $443m versus $390m in the prior year, a 13% increase. Approximately $9m was from acquisition so organic growth is closer to 10%.

Operating margins were 10% higher in the current year, increasing from 8.1% to 9.7%. The EBITDA bridge in the Investor Meet Company presentation indicated that 0.4% was a result of the copper price & FX.

Per my own calculations and in particular adding back the share based payments (Options represent some 7-10% of the shares in issue), I think a more appropriate operating margin is closer to 8% (and 7% in the prior year).

Gross margins have remained flat - which management attribute to the product mix (Consumer Electricals & Electric Vehicles), which have been offset by process improvements.

I could contend they are actually down slightly given the inventory build.

Operating expenses increased during the year, however, the business benefitted from lower travel costs and strict controls around discretionary expenditure.

Reading the full year results, it demonstrates how much uncertainty there was 12-15 months ago.

There was growth in all regions but clearly North America was the best performing region - indeed management allude to strengthening the marketing team in North America and it appears this has delivered the goods.

The company has continued to spend on improving and expanding its production facilities and the benefits of this is shown in the improving margins.

Looking at the business segments and my view thereon going forwards:

Impacted by the focus on the sector on CoVid procedures - this is consistent with reporting of a number of companies in the sector.

I think the nature of the healthcare backlog in my view is a slower longer recovery - you cannot suddenly increase capacity and the backlog will take time to work through.

In the short term I would expect a recovery, however rather than a 10% recovery, I'd expect this to have a more gradual recovery but this to last longer than is anticipated.

Consumer Electrical

While showing growth was actually flat on the year when excluding $9m from the DEKA acquisition.

I am disappointed by the performance here given the boom in home working/sales of electric devices.

That said, similar to the medical business, I think this is a relatively stable business. Just as I expect there to be more demand for healthcare over the coming years, I expect there will be more electrical devices.

However, having just written that, my walkman/discman, digital camera, mobile phone, diary, pen & notebook have all been replaced by a single device #Deflation - so perhaps the market will not expand as I think.

Pontifications aside, I am looking at nothing more than inflationary increases here about 3% + a full year for DEKA.

Upside to the electrical business may come from the DEKA acquisition - Management were positively beaming about it on the call (and indeed their own ability to source the deal in the report) and talk about revenue synergies (which are much better than cost synergies in my view).

Industrial

Growth was driven by Data Centers which went from 30% of industrial technology to 36%. Excluding Data Centers, the growth is negligible but suggests 30% growth in data centers.

From what I can read, there was definitely a slow down in general industrials in the past year and indeed investment in digitalisation was a recurring theme and this is reflected in the results.

While, the same levels of data center growth is unlikely to be repeated, I don't think this is slowing down (i.e. it is still showing strong growth - as an aside I would include the Video Gaming sector here too).

I'd expect continuing recovery in the industrial space.

Electric Vehicles

The star of the show albeit a much smaller business.

I am not sure if Electric will be the future. One of my Operations Management Professors from the MBA who is a specialist in automotives said in a recent lecture that he believes Hydrogen will have to play a major role in the future of automotive - As an aside, he told our class to buy Amazon and keep buying it for the rest of our lives, when Amazon was around $200.

In the short run, electric vehicles seem all the rage and personally I think the picks and shovels play and the work they are doing in the charging infrastructure is in my view a far more sensible way to play this theme.

I doubt revenues will triple again but this could be a high growth area - up to 30%.

Where it might be next year and the year after

The long and the short of all of that is I make revenues to be in excess of $500m and on a bullish upside recovery scenario, could be closer to $530m, including the full year benefit of DEKA.

Versus forecasts of $507 and $533m, I think there could be some upside surprise although I am not sure the margins will be as good as the current year - forecasts at 9.5% and 9.7% in 2022 and 2023

My reason for some margin contraction is that the copper and FX benefits won't repeat (0.4%), travel cost savings which were a one off (0.3%) and every industry is facing inflationary pressures / shipping costs.

With their leadership and the ability to pass on materials prices (with a lag), they are perhaps better able to deal with these challenges, but if management is relentlessly focused on protecting margins, there must be a reason they focus on that.

Finally, Electric Vehicles is likely to be a bigger part of the business going forwards and this is lower margin. Further it is flagged, that this is likely to become more competitive.

The longer term Operating margin target (2024) is 10%. Certainly, if it was management alone and no external factors I would say this is achievable but there are macro uncertainties.

The revenue target $650m (which includes potential acquisitions is far more attainable given the stated target to achieve 10% inorganic revenue growth.

On the production front, they have expanded their facility in Batnam Indoensia and are moving facilities in China (Enterprise incentives).

The China move seems to facilitate innovation and given China is intensely competitive (from what I know), I think improved collaboration can help. That this move was required as a result of outgrowing previous facilities is a good sign.

The expansion should help margins. Also, as they improve their capabilities (Organisational learning) around Electric Vehicles.

Balance Sheet

Being an accountant, I like balance sheets.

That said, I think balance sheets tell you about the efficiency of the business (profitability and profitability of growth/cost of expansion), or alternatively can be a constraint on the busines (liquidity or debt).

In this instance the Balance Sheet is fine, although there has been a big build up of receivables & inventory (after an unwind in the PY).

I will let them of given the acquisition ($26m in additional receivables) but I would like to see some details around this in the annual report.

Ex working capital, the business is cash generative and has access to liqudity.

I do question why they hold $31m of cash and $38m of debt, but again could be explained by the inventory build. I do note that the PPP Loans have been forgiven saving $2.8m in cash out flows.

There are some provisions there - generally not a fan of balance sheet estimates for many reasons, but they are not material (yet). The legal provisions could come and bite in the posterior, but given the disclosures at the moment and the indemnifications, this is a manageable risk

Outlook

Management state that they are very encouraged by the first two months and have received enquiries from existing and new customers including cross selling Volex/Deka customers.

As I note above, management are focused on margin and intend to do this via process improvements to manage inflation, which is far better than a strategy of hope.

Maybe this is looking to glass half full but I think management in Indonesia & Turkey are likely more cognisant of the risk of inflation and how to manage it. Russell Napier has been vociferous in suggesting that asset managers bring their EM managers to work on developed market equities.

In the even that inflation is transitory, then this is all a moot point. Indeed given the inventory build they might even be a beneficiary of an unwind in the copper price.

The transportation and associated costs I think will start to reduce, albeit I think the lead time in this regard is a little higher than people anticipated (at least at the end of Q1).

They reiterate their 2024 targets of $650m revenue and $65m in Operating Profits.

Comments

Post a Comment