June Week 2 - Inflation Up & Yields down - Oh the humanity!!!

Inflation Up & Yields down - Oh the humanity!!!

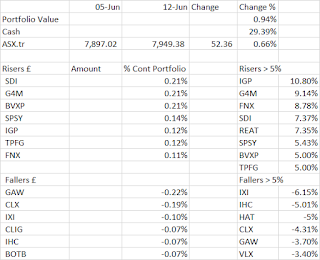

Portfolio Review

A good week for the portfolio with strong updates being the drivers of portfolio performance as well as what seems a fair amount of summer volatility. G4M got tipped, IGP had good results.

I am still easing back into things and would suggest I need to start working harder. A couple of transactions in the portfolio - freeing up cash in the account where cash should be held - ITs trading at pretty large premiums to forward forecast NAV.

Cursory Market/Macro Observations

My mum used to say, if you have nothing to say, say nothing.

Unfortunately for her, I was a loudmouth and not the best listener.

So for the sake of saying something, CPI data came out - apparently the markets were quiet waiting for that print in earlier part of week.

It was a big number, but actually its transitory because the components are reopening related, energy/food prices are not relevant to consumer spending and whatever else reason takes your fancy.

Yields fell, Banks fell, Growth & Big Tech rallied - people were very very surprised that the market did not move the way they expected/predicted.

I must say, given that there are some incredibly smart people working in these markets, boy do they not learn!

Of the explanations around, I found the Treasury General Account quite a plausible off piste theory, but don't really care enough to actually go any further.

Lessons:

Obviously, with two strong weeks, I am back to being a complete and utter genius, with EBITDA shining out of my posterior, that said:

Writing the note was particularly helpful - still pretty annoyed by the whole "When Money Dies" phenomenon, but doesn't mean I have to kill myself - especially not with anger - far better ways to go I think.

Write more - get the lessons of 2020 done!

Transactions

Sell AUGM

The company announced a planned fund raise, based on updated NAV - my view the company was trading at a substantial premium to NAV and the fund raising would be at a discount to current share price given the premium.

Not willing to add pending results/fund raise details - believe will get opportunity to purchase at discount post placing.

Tail type position - want to reduce these or add to make good & free up cash given aggressive purchases last week & want funds to potentially add to other holdings.

Sell GROW

As per the prior week, trading at a premium to NAV and what i considered to be a 10% premium to fwd NAV.

Sold out - after the reduction - last week had become tail and was not willing to add.

Incidentally, both these companies announced results in the following week, the latter a fund raise.

I was right re GROW & the announced a fund raise at £8 - if I hadn't had other things on / prioritised could have bought back at discount.

But premium to NAV, which I was surprised by given the commentary in results and then price went up.

As for AUGM - I am obviously a genius! Until I am not!!!

Both have a very interesting set of businesses and do something I am not able to do myself - a very good reason to hold a fund!

Keep on radar.

GROW said the returns they delivered they are unlikely to repeat, so I am surprised (wrong word) with the appetite on placing premium & subsequent share price resilience.

Both remain very firmly on the watchlist - and are potentially interesting adds for the wife's portfolio.

Portfolio Risers

IGP up 10.8%

- Very well received results and I was impressed with the explanation as well as metrics.

- 6% revenue growth, 14% in US, all other regions down - impacted by ability to do sales but trying to work on it.

- New product development geared at expanding market and moving down the chain & continue to win new clients and also govt - again compliant with specific standards - good year operationally, specifically staff T/O.

- GM at 97%, costs of 10m R&D tax credits continuing so unutilised losses not utilised from profits - basically no tax to pay for a while. NTM could be 12m rev, 2m OP profit.

- Costs stay flat on year, probably some CoVid savings - what is really impressive about this company is that the deferred income & long term deferred income

- Very cash generative - because of the big increase in deferred income - again I am very interested in that deferred income balance!!! ANNUAL REPORT & why are receivables falling.

- Positive - Investment thesis in tact - Add to Hold - Valuation toppy but if weakness.

G4M up 9.14%

- Got tipped by Stockopedia & at Mello - agree with them.

- Glad I added the previous week - see Genius!!

- No view - Investment thesis in tact - Hold

FNX up 8.78%

- Been a bit up and down and coming back after two weeks of weakness?

- Very illiquid

- No view - Investment thesis in tact - Hold to Add - wouldn't mind this becoming a bigger position but a fair amount of one off work in PY could hit current year results

SDI up 7.37%, REAT up 7.35%, SPSY, 5.43%, BVXP 5%, TPFG 5%

- No idea / noise, coming back after some weakness in previous weeks (SDI, BVXP, SPSY.

- REAT & TPFG seem to have some pretty good momentum with them

- Hold - TPFG is most interesting notwithstanding the very strong run it has had

Portfolio Fallers

IXI down -6.15%

- No news that I was aware off - expect there are some stale bulls given profit warning or someone is building a position.

- Hold, expensive given M/Cap and the results were a little bit not sure but real profitable company in a proper theme - Note admin sale transaction pending

IHC & HAT down 5%

- Both are illiquid small caps and been a little bit noisy - maybe some post ex-div selling, maybe the travel currency thing.

- IHC has had quite the run so pull back makes sense, although this is the second week of the pullback.

- HAT is doing a lot for portfolio & ex High Cost Credit seems very cheap for normal returns - FX is small business and fully expect pledge book to recover as people start spending (and potentially have more items to pledge)

- Hold to Add, more so on HAT given portfolio benefits

- Wonder if IHC is impacted by these lower birth rates, but device going OK, which hopefully benefits pipes

- IHC - when in doubt do nothing

Updates & Results

Some of the results are covered in the movements, namely IGP. Other than that, my take on SHED (REIT holding Urban Logistics assets), British American Tobacco & an announcement from SigmaRoc

SHED

- NAV 152p, LTV 27%. Increase in value of 13% on LFL. WAULT 7.4 yrs from 5 years - NB Portfolio value has nearly doubled because of acquistion activity

- Dividend of 7.6p - shade under 5% on share price of 160p vs forecast NAV of 161p. Premium to NAV, but less than the larger caps (comparable to sector to be fair)

- 264m in acquistions in period (out of 507m Portfolio value) - 36 units 6.2% NIY, Rent collection at 99% & LFL rental income upped 6.5%

- Exit yields on disposal - 4.8% - Available funds to be used on development activity on existing assets - have pipeline but will require more fund raising

- Aim to get Premium Listing (and use issue of shares to obtain higher M/Cap to make premium listing wothwhile) - Stupid, although the manager does get more AUM!!

- Long story short - sector booming and lack of supply / increasing build costs & available opportunity - seems a little bubbilicious or alternatively genuine shortage

- Apparently this more acute in Europe (Hello EBOX) - very consistent with what is happening across the board though.

- Premium to NAV so don't want to add but no reason to sell at moment (unless want to churn).

- Also, new fund raise so better keeping funds for that to add (vs adding in market).

- From portfolio perspective, have WHR, SHED & BBOX in REIT portfolio - all done well - probably don't need all three & could look to diversify into alternative real estate space or something else entirely - infrastructure maybe - no exposure!!!

- Was telling that in Stenprop restructuring to multi let industrial (good I thought), they decided to retain the Urban Logistics stuff

- HOLD - Investment thesis in tact

BATS

- Raised guidance to 5% constant currency revenue growth and gaining market share across reduced risk/non combustible and gaining share in combustibles

- EPS growth mid single digit and leverage at 3x by year end, cash conversion in excess of 90% (2nd half weighted - fine excise duties related).

- Not expecting a recovery in travel until 2022 - interestingly travel stock prices suggest otherwise.

- Still doing the job in terms of paying the dividend - hideously cheap given that the business is actually growing revenues and earnings. Heavy debt load, but money is free!

- Interesting that they are at No. 3 in sustainability index.

- Exlcuding tobacco & debt, I think this is quite comfortably the best stock in FTSE 100 given quality/value & what seems to be a turnaround/improvement in trading, not to mention the blue sky potential from cannabis

- I would suggest this is a back the truck type position, but then to what extent can you ignore the tobacco - when their main business is selling tobacco!!!

- HOLD to ADD - Investment thesis in tact - You would add if you had the cojones!

SRC

- Expansion of Greenbloc range to the whole of Precast Products Group - cement free.

- Cement uses a lot of carbon so not surprised it has been well received.

- Seem a very talented management team doing buy and build, new products, margin/territory expansion.

- Expect trading is going strong given updates from builders / builders merchants

- HOLD to ADD - Investment thesis in tact- thought about adding to this multiple times and not getting round to it - probably the sector competence to be developed.

And on that note, A Dieu

Comments

Post a Comment