June Week 1 - Meme Mania - Would the Real Wall Street Please Stand Up

Meme Mania - Would the Real Wall Street Please Stand Up

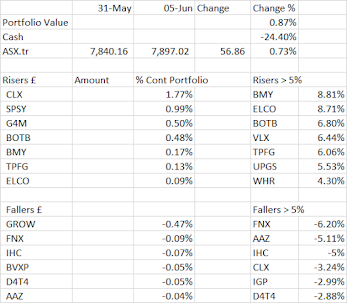

Portfolio Review

A good week for the markets and the portfolio - BMY results were excellent and very well received by the market. Other risers seem to be companies that are recovering after a bout of weakness.

The big contributions/detractions were a result of transactions - FNX is sustained but very illiquid and could be position building.

At time of writing, hindsight confirms FNX was position building - lets see if Hindsight is still correct next week!!

After all the dramas and writing last week, I was fairly detached from markets - only reading companies that reported & I hold & a bit of general reading, limiting talking heads entertainment & some afternoon drinking.

Indeed, I spent the bulk of the week getting out of my funk - the rather ranty/long blog post being a function of this & working on the lessons from 2020.

Maybe not the most productive use of my time but think it was helpful - more relaxed this week - although maybe that is just a function of the portfolio recovery (which has been known to happen).

Cursory Market/Macro Observations

So it is summer & the talking heads have to create some news and Meme Mania has taken over.

Either this is all a bit of fun or somewhat reminiscent of some of the things that were described in "When Money Dies" - great book, wish I hadn't read it!

Meme stocks are to be ignored but from anything I need to spend any time caring about from a portfolio perspective other than monitor the composition of funds / ETFs and to what extent it goes outside the traditional Meme universe (or is there a Meme Factor??)

I wonder how the BUZZ ETF is performing?

The craziness reaffirms my view of the fact that passive investing - which in my view just accepts whatever piece of stupidity the market throws at it. If you bought a Russell 2000 ETF (IWM) today (which a lot of talking heads still suggest), Gamestop, AMC & Caesars will be your biggest holdings - maybe they were value / cyclical recoveries / roaring 20s plays, but today I think they are well and truly anti-Value (and maybe anti-Investing).

Two flaws in this logic however;

You are taking market stupidity as a given as opposed to not realising some shift / rotation;

If you did buy the ETF, you would have been able to participate in the upside!!!

Lessons:

Big week for lessons last week so will chill out this week.

To be honest, in the interest of being a little less hard on myself - while it was not the most productive week (health/wealth/Investment), it was useful to step away from it all.

As I wrote that section for ETFs thought about a couple of things:

For me personally, I think it is important to look at the index & diversification within an ETF.

Be conscious of concentration across funds/geography/sectors/themes - eg Nvidia (Gaming, Robotics/Automation, SemiConductors) and obviously a large part of the index funds too.

Also - with respect to cash balances, you seemed to be a reasonably aggressive buyer but because some opportunities came up - in light of your general view and wish for cash allocation - you need to start acting on reducing holdings - i.e. net seller for rest of June

Transactions

Add G4M

Small add - think it is one of the best GARP type shares - well timed as well as it got tipped on Stockopedia the following week

Red GROW

Needed to free up cash for G4M add and is back at premium to NAV.

Add SPSY

Unless I am missing something, there is a big chunk of revenue to be earned over the next two to three years which is not reflected.

The sustained weakness is somewhat disconcerting but given dividend/growth/profitability it seems very attractive.

However, given M/Cap, think there is a constraint on position size now

Add CLX

Pretty much as per last week - very happy and want this to be a larger holding - as noted in previous week notes, more patience and heeding the May Week 4 lessons would have enabled you to get in 20% cheaper.

And if you liked it at 1.20, you like it more at 1.05 - which I do!!

Portfolio Risers

BMY up 8.8%

- Excellent results with an upgrade to current expectations.

- Books have been booming in the current year and strong growth in consumer but a little lower in the academic/professional

- Growth in academic/professional digital and completed acquisitions to strengthen content library - Momentum is strong with this one

- Seems to be a clear strategy and good operating momentum - tough comparatives going forward, how long can Harry Potter / Back list continue to deliver, to what extent is books a one off

- That said - absolutely no reason to sell - they did upgrade guidance - happy to let this become a bigger position than now

- Positive - Investment thesis in tact - Hold to Add

- Revenues in consumer up 22% to 118.3, Non Consumer 1% to 66.8m - Total 14% to 185m

- Consumer PBT up 61% (WOW) 14.2m -

- Children Revenues up 22% to 74.6m, Adult 17% to 43m - Profit up 16% to 14.2m - 42 & 145% growth respectively to 10.4 & 3.9m

- Backlist continues to deliver and some successes on current year titles

- Academic/Professional up 3% to 44.3m - digital resources 12.3m up 49% 4.3m Profit & 2m Profit in digital

- Special interest down 1% to 22.5, PBT at 1.1m - smallest part of business.

- Strategy to integrate new publisher content within digital resources, conitnue to work with authors/aquire titles

- Digital & international is the growth area (being more in the creative end of digital is interesting), continue to invest in core business through delivering titles

ECLO up 8.7%

- Ilqiquid, coming back after some weakness maybe. No idea what is happening

- Erring towards sell based on LIFO, technology overweight & current issues with s/holders governance make me a little uncomfortable and in particular not something I would add to unless there was severe weakness

- Neutral to Negative - Investment thesis in tact - Hold or Sell (for portfolio reasons more than company reasons)

BOTB up 6.8%

- Seems a volatile period and coming back after some weakness in previous weeks - thought there seemed to be some position building and thought about adding but position size discipline may end up costing me - did think about adding which would have been near a bottom I think.

- Hold to Add - Investment thesis in tact - Hold to Sell

VLX up 6.4%

- No idea, coming back after some weakness in previous weeks.

- I am concerned about the inflation impact here, but with the growth around data centers/electric, maybe they can grow themselves out of any margin pressure (a la UPGS, which you still regret doubting!)

- Hold

TPFG & UPGS up 6 & 5.5%

- No idea, maybe some accumulation / continuation of momentum from previous weeks.

- Feel valuation is getting a little full on both of these given type of company but both are high quality operators/management, good profitability/returns on capital, dividend and growth prospects

- Property though - seems to have had a bubbilicious run and management have said as such, so will be facing very tough comps.

- UPGS - from what I am seeing / reading the extra cost pressures are not abating much (especially around the shipping / transportation costs, but might be a beneficiary of any supply shortages, because they are better at it.

- Think about both of these in detail - Fit the never sell / long term mantra versus the short term weakness.

- Hold - Remember the bias - when in doubt is to do nothing!!!

Portfolio Fallers

FNX down -6.2%

- FNX weakness is somewhat sustained but very illiquid and could be position building.

- At time of writing 9 June 2021, hindsight confirms position building

- Lets see if Hindsight is still correct next week!!

- Did think about adding on the weakness but was put of by sustained & again in weak 2, but dilly dallying & didn't execute before it moved away

- Happy to hold & let this become a bigger position - Hold to Add

AAZ down 5%

- Seems to move in line with gold but with higher beta - makes sense given it is a high risk territory gold miner.

- Some interesting noise about new territories in results so happy to wait to see that play out.

- Other than that perceived value, there is very little reason to be holding this given the circle of competence, especially since it is such a small position & not sure willing to add vis a vis circle of competence / country risk

- NEUTRAL - Investment thesis in tact - Hold

IHC down 5%

- Small pull back after a strong run up post results

Updates & Results

I had a pretty lazy week and I published las week on Friday so not much to say.

I only really spent any time looking at companies that reported (Bloomsbury above) and Augmentum announcing two new investments.

Augmentum

- Made two smallish investments helping people with financial planning/savings management - one in France & one in UK.

- Would be interesting to look at the valuation these guys got versus where PensionBee is trading - not sure if I will actually do this as unlikely to buy PensionBee

- On 7th June, they announced an update saying they are planning to raise funds, will publish prospectus and updated NAV

- I thought about exiting immediately (company trading at substantial premium to NAV and unlikely there will be sufficient uplift in NAV.

- Given market conditions, I am not sure there will be much appetite for funding on a premium to NAV.

- Exited on 9th June - reasons above + free up cash in light of purchases made in previous week & portfolio considerations (position size vs willingness to add).

- Note if acted immediately in stead of dilly dallying, would have saved 3%, but as it turns out given weakness today, was good to exit - see where we are in a couple of weeks.

- Results on 14th June be interesting

Ok - think I have earned another afternoon beer - following which I must finish reading properly SHED results & carry on with the lessons of 2020.

Comments

Post a Comment