Some Portfolio Analytics

Terry Smith's Metrics, My portfolio & the All Share;

My Metrics versus the Index;

Assessing potential sales - #GSK, #TSCO, #AAZ, #LSEG

Its a quiet day, so I thought I would take the opportunity to take a look at some portfolio metrics, taking inspiration from Terry Smith's Annual Letters.

There has been a big shift in my investment methodology since April 2012 - my chosen start date - having moved away from value / contrarian / falling knife to quality, business & valuation focused.

I still retain a "value" bug but actually I find reading about / analysing good businesses far more enjoyable.

Indeed at the start of 2020 I wanted to start a long term high dividend portfolio - one of the holdings I bought was Carnival - I decided against high yield to a reasonable & sustainable growing dividend.

Everyone has a plan until they get punched in the mouth - wonder what happens if quality capitulates like value??

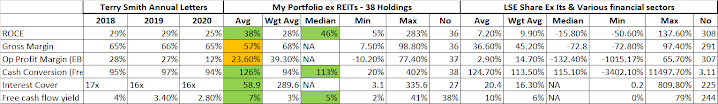

Terry Smith's Annual Letters

These are great short reads, albeit a little repetitive, but here is how I compare on the key metrics versus Terry Smith & The FTSE All Share.

Points to note:

- Some metrics are flattered by holding #HAT - a financial services businesses - I did not exclude from my metrics;

- While I tried my best to get rid of the financials/investment companies, I am not sure how complete this was in the context of the FTSE All Share;

- All my data is taken from the excellent SharePad

- There might be some date issues - in fact I might start doing this on 31st March & 30th September such that I should capture majority of half year & full year results

- Data quality may well be an issue

- The weighted average for my portfolio is kind of meaningless due to Microsoft

There must be a data quality issue in the comparison with Fundsmith because my portfolio seems to have a better quality & value score.

Admittedly, I don't have quite the same size/liquidity constraints he does but I hope it bodes well for my future returns relative to his, because historically he is so far ahead, it is not even worth doing the Maths.

We both trounce the UK index on quality but not on value - I expect oil & mining playing some role there.

I like the CROCI 7yr avg versus PY - this suggests that the cash profitability of my portfolio is improving.

I think HAT is impacting the free cash flow metrics for current year versus forecast.

I have 38 holdings currently and would be between 30 & 35, 40 being the cap.

LSEG & Supreme are two very recent additions.

As I hold 4 companies with M/Cap below 50m, (M/Cap cut off previously) and only one of these is loss making, I am about OK with the number of holdings being at the upper end.

I would argue none are purely speculative in the business / operation context and certainly not what I consider poor quality (at least ex-quantitative).

I think the EBIT margin is somewhat unfair in terms of reflecting the quality of my portfolio.

I own a few what I consider high quality distributors - I think with such businesses a sign of the quality if Operating Margin vs Gross Margin and quality can be measured as GP on assets - assessing such businesses this way (which maybe wrong) results in better quality than they would be given credit for.

Also, they make sure customers are looked after & well supplied - low margin it maybe, but seems kind of important.

Assessing some potential sells in the context of those metrics as per below, the issue becomes what do I replace them with - and if I had the cojones, I am pretty sure GSK & Tesco would be replaced with BATS - all being holdings as part of the dividend portfolio.

The only issue being, it is all well - cheap because of ESG - not being a private buyer with influence - I need them to re-rate.

From a portfolio perspective, other than the leverage - it would improve portfolio metrics substantially.

GSK - Is there a reason to hold

Pharmaceuticals are considered a high quality defensive business and I agree, however Terry Smith is not a fan.

He talks about heavily adjusted results and large capital / R&D investments that may or may not pay off and will have a finite life & need replacing.

For me, the margins are higher than my portfolio and so is valuation. I am sure if I went for unadjusted, that would not be the case.

Debt adjusted PE suggests that the value is not as obvious as other metrics would have you believe.

In realising value:

I will be left with a pharmaceutical business I don't understand desperately fighting patent cliff & trying to buy pipeline while other people are too (which may turn out spectacular); and

A good quality but highly indebted consumer healthcare business, which should be steady and maybe a bid target.

I am struggling to find a reason to continue holding.

AAZ - If you need to look it up on a map, you probably shouldn't hold

Being a miner, it is never going to be high quality, but as far as miners go & within my portfolio it is cheap.

I would not buy this today because I am more conscious of competence than value but given the value & goldbug, I don't want to sell.

Really should be sold - especially given the tiny holding.

TSCO - Lots of value, but could become a value trap

When I talk about some distributors which I think are higher quality, I do not refer to this holding.

If I applied a screen, Tesco would not qualify because I am sure my margin requirements would be in excess of 2%.

It was purchased as part of the income portfolio I built in 2020, although I bought Tesco in 2021 and I think it was a lack of inspiration search for something defensive that led me to purchase it.

Part of the reason I bought it was that I knew I would get at least 20% of my capital back.

It provides a nice safety ballast to the portfolio and is there as a bond proxy.

I hold Supermarket Income Reit too - I think that is a better bond proxy, albeit at a premium to book value.

If I was a hard nosed capital allocator, I would sell but I am more reluctant with this than AAZ or GSK, partly due to my circle of competence but mainly because:

I don't think Tesco will make me rich but it will be a reasonable place to keep some savings.

LSEG - Lots of quality but could become a quality trap

Being the most recent addition, it is on the chopping block.

I want to hold this for the long term - I think it is a very good place to keep your money but I have had a bit of luck trading.

I think this is a high quality operator, but not without risk.

Notwithstanding the trading luck, I had an exchange yesterday re Hargreaves Lansdowne - I would suggest it is looking just as good as LSEG after yesterday's block.

Neither are what I would consider cheap but I think the disruption risk is less with HL.

In a twitter exchange, I mentioned that I didn't think it smart to buy market sensitive stocks at the moment. LSEG through the Refinitiv deal is less dependent on market activity but I expect it is still pretty high beta.

It could be a sell - but more an opportunistic sell.

Comments

Post a Comment