August Week 4 - Something from Nothing

Nothing;

Adds: #BMY, #SDI

Updates from #PHP, #VLX, #SRC, #UPGS

As much as I like to talk, I don't have much to say this week - I was on holiday for all practical purposes and will remain as such this week & next - staycating!

Good timing, given that someone seems to have turned of the RNSs.

To be perfectly frank, it was a whole heap of nothing (or maybe just me).

Public Service

No recommendations this week - as I say kind of a week of nothing - hopefully some holiday reading will result in book recommendations but not making any promises.

Cursory Market/Macro Observations

After all the concerns over BRR in the previous week FED minutes, we had something come out of a hole in Jackson.

The market clearly liked what the only game in town had to say.

Inflation is transitory - honestly it really is - think there is a great divide here & I am on the inflation/financial repression as the base case.

I see some of the transitory brigade have started suggesting that we are not going to be in Weimar Germany - using Weimar Germany to support the transitory narrative - seems quite the switch no?

Anyway interest rates are never going up - there might be a taper but not if the Chairman can help it.

With various speakers desperately trying to ask the market to dial down the leverage, it appears the Boss Man said - NO NO NO - Markets only ever go up & you better lever the **** up.

In the meantime, there continue to be certain regulatory "crackdowns" in China on some of the tech - video gaming hours are being restricted - obviously because it is China, it is evil & oppressive.

My parents on the other hand, just wanted the best for me (many years later I completely agree with Mummy & Daddy)

Quite the rally in the week & I wasn't following particularly closely but seemed to get quite the move up on Friday post FED confirming that they are in denial about inflation & will never raise interest rates.

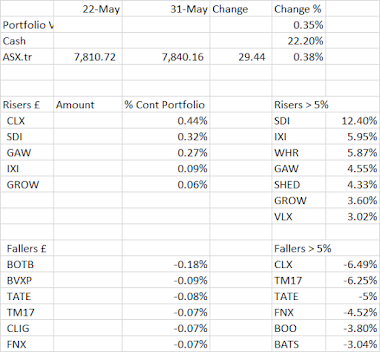

Felt like a decent week for me - SDI addition & fortunate timing helping the portfolio.

Put a little cash to work but still on the high side I feel - in particular I think the SIPP level is too high - might be a call for some moving around the accounts.

Lessons:

None for the week - I am sure there are some but I am effectively on holiday last week until Mid September.

Transactions

ADD BMY

- The outperformance in the trading update versus the previous forecasts & in line statement seemed inconsistent and get feeling could be upside to forecast.

- Finding place for the cash freed up as a result of sales in the previous week.

- HOLD - Full sized

ADD SDI

- As I noted in the last week list of fallers, it was starting to look interesting.

- On a particularly moody day it fell back to the levels at which it announced the two year upgrade - was after Annual Report published, but other than Working Capital, looked fine to me.

- I felt positive after the call - if you believe that cost pressures can be managed / passed on & marketing benefits from re-opening and the potential for Atik to maybe continue past 2022, there is upside.

- Got lucky on timing - WooHoo. A little crowded & Buy & Build risks - lot to like.

- HOLD - More than full sized!

Portfolio Risers > 5%

SDI up 10.1%

- Quite the rally after a couple of weeks of weakness/share price drift.

- Got quite a lot of volume at 150 (I was part of it) - which was the crazy two year ahead of expectations breakout level.

- Wasn't expecting the rally to the same extent & getting a bit toppy.

- HOLD - maybe a mild reduction for sizing purposes.

VLX up 6.5%

- A well received acquisition with some broker upgrades to go with it.

- Irvine Electronics acquired for 16m$ - existing cash & debt facilities - defence military aerospace markets - manufacturer of electronic solutions - printed circuitboards assemblies

- Adds to presence in NA - West Coast in addition to Washington State - note state! & Mexico - enhance circuitboard capabilities - vertical integration - US defence is a good but very tough market

- Seems quite the deal - some one off factors in prior year - but even excluding that - 5x Adj EBITDA seems very attractive & no share issuance so should be good for EPS

- Why are they accepting such a deal & no earnouts / deferrals as is standard - does the seller know something - doesn’t talk about existing management team.

- $650m revenue & $65m Op Profit target in 2024 (adjusted) vs EV of 635m - $800m - would suggest that is largely priced in

- From a strategy /long term - post 2024 perspective - does feel like it is going on a Diploma / Bunzl esque journey in electric components & that is not the worst place to be at the moment

- Position sizing aside - HOLD - Good deal but do question why it is/seems so good

SRC up 5.91%

- Good set of results - big growth but organic growth at 13% Revenue & 17% EBITDA is pretty reasonable - sound moves from an operational perspective. Greenbloc potentially exciting but expect a lot of competition

- Acquisition of Nordkalk dominating the narrative & outlook - confident sounding.

- Nordkalk - 7x EBITDA (LTM) seems competitors are closer to 5x & at EBITDA margin of 24% versus last 15 years at 15% (peak margin?) - above SRC's own!

- Enlarges group - revenues grow at 5% per annum & EBITDA margin in excess of 20%, Net Debt 2x NTM EBITDA - market leading materials group in Northern Europe

- New LTIP Of course (EPS & TSR) - 95% Op Cash conversion, Capex below depreciation - free cash flow to Enterprise approx 60m, ROIC at 15%, not bad - continued opportunities for expansion

- Management seem impressive - have done what they said - lots of share issuance & lots of Adj EBITDA, EPS moving in right direction.

- Depreciation is a pretty big number to ignore but they guide free cash / ROTIC - lots of intangibles get added on acquistions & EBITDA is adjusted for these charges

- 20 year life, long term growth rate 2%, discount rate (expertly sourced) at 8%, which seems lighter than free cash / earnings yield in the sector

- Pro-forma - 376m Revenues, 137m GP (about the same), 83m EBITDA - margin is higher than the target for the enlarged group, although call mentioned that reference to 20% + was existing group with 50m Op Profit and approx 5% Minority Interest gets to roughly 800m in EV

- Think the valuation has gotten ahead and want to see the LTIP & post acquisition balance sheet - with adjustments for share issuance & so on, seems more expensive than Holcim/Heidelberg

- Very good in terms of portfolio fit, Mgt impressive & came across very driven and with a clear plan - Really need to trust them though

- HOLD - could be Add but not yet

UPGS up 5.67%

- Another well received trading update from what seem a very impressive management team.

- Revenues at £136m - up 18%, all four areas strong - supermarket/discount/online/international

- 11.2m U/L PBT up 36% & EBITDA up 28% to 13.3m - PBT ahead of expectations. Net Debt increased 15m to 18m, 17m Salter Acquisition. 16m headroom, What about 10m profit?

- Order book ex Salter ahead of this time last year - not surprising, things were only starting to improve - retailers have been stocking & as things slow down, will destock?

- Shipping availability challenging - prioritising group forward orders from retail customers ahead of stock purchases - current trading in line - growth from core + Salter - shipping will remain disrupted until 2022 Chinese New Year

- 2 year growth - 123.3m - 10% - which is very reasonable. U/L EBITDA 10.4m to 13.3m & PBT 8.4m to 11.2m - very decent growth in the context of historic multiples - even today it is OK

- Impressive management but the headwinds make me uncomfortable - China risk / Margins are improving + with impact of Salter + perm WFH - maybe can be maintained

- Part of quality is speed at which they can turn their inventory over & that is at threat - if it wasn't for the macro so much to like as this quiet compounder.

- Net debt movement suggests working capital requirement increasing + retail customer prioritisation - ahead of stock purchases (assume refers to online/D2C which is higher margin?)

- Maybe keep bigger customers happy at expense of online target - make the customer's buyer look good? - Not selling - everytime I have reduced I prove to regret it!!

- HOLD

IGP up 6.12%

- No idea - noise or technical reasons!

Portfolio Fallers > 5%

BOTB -6.16%

- BOTB - noise after the events of previous couple of weeks - probably the spread!

- HOLD

Updates & Results

Unlike previous weeks, the big risers in the week were the folks that updated the market and results were received quite positively - as described above.

The only other update, not included above was from Primary Health Properties.

AAZ did announce some results from a geological survey - but it may as well have been written in Azerbaijani for what I understood - nice that they share these things though.

Again, I question the rationale for continuing to hold this company.

PHP

- Bought Townside Primary Care Centre & adjacent office building for £40m - Bury Lancashire

- Primary care - purpose built - let to NHS & Pharmacy & Office let to Bury council.

- 90% of rent - WAULT 10.8 years, 91% govt backed tenant

- Contracted rent roll now over 138m - interestingly they did not mention the initial yield or the rent roll

- 136.1m at interims - guided 1.2m increase from rent reviews once completed - would put this at either 2m additional or 1m additional

- Get the feeling that is NIY was 5%, they would have disclosed it - 4% forward dividend

- So overpriced - 50% premium to book - government backed is very nice but they are a great big powerful customer that if they don’t like the terms - can put you in jail!

- HOLD

And Finally

Congratulations to my cousins in Delhi, who have welcomed a brand new baby girl into this pretty amazing world.

Wish you all the best - muchas love!

Adieu

Comments

Post a Comment