November Week 3: 🤔🤔🤔🤔🤔🤔

Thinking out loud;

Risers/Fallers/Transactions - #BMY #BOTB #G4M #TPFG #PFD #IHC #EMIS #CLX #CWK #SUP #BVXP

Updates from: #FNX #FCAP #SHED #PHP #ULVR #SUPR #BNZL #GAW

I started thinking of my lessons from 2021 (and I dare say the route of my underperformance started on Vaccine Monday) and general approach and thinking in terms of risk - Risk taking vs Preservation of capital - and may well explain some of the transactions this week and what I am thinking.

More in the 2021 review, but the 2020 & 2021 Mid-Year are still in draft (would have been very useful exercises and reduced the length of the 2021 version.

Also, people talk about 50s/60s/70s (which prompted the most recent book choice - John Neff Investing) as it turns out - recovery after very tough times (the desire for fun and may explain why Baby Boomers are the biggest generation), The Great Depression out of site, The technology industry/Nifty Fifty & forever stocks.

I read an article about how the Gods of Capital are congratulating themselves for fantastic returns as a result of tax policies & interest rates, neither of which is a function of their genius but LPs don't need to know that - one of the comments in that article concluded from someone a little older and dumber said it feels like we are in a .com bubble valuation with 07/08 leverage (didn't save the link unfortunately).

Fun times - lets see - I would not be surprised if everyone is wrong.

Cursory Macro/Market Observations

Bit of a downdraft in the markets this week and conditions seem like the market is taking a turn for the worse - risk off as it were, or maybe it is just me.

My own holdings particularly small caps have been especially hard hit & any disappointment has been punished.

Indeed, over the course of the year - this has not been one for buy & hold investors - there has been some stomach churning volatility (ULVR has been in a 20%) so good traders I am sure have done well.

ECB continue to do nothing in the face of inflation and that crushed the Euro, which was really the only thing I noticed, fortunately it is not a function of monetary policy but rather fresh lockdowns.

Europe has new CoVid restrictions and we don't HAHA and I see there is some drama about mandatory vaccines & restrictions for the unvaccinated hurting travel & leisure stocks but not as bad as the first time - Wil E Koyote & Road Runner?

I am not sure of restrictions on the unvaccinated but on the off chance that my Dad reads this (for reasons I can't disclose) I am used to being discriminated against.

Very dangerous to use equivalences but seems a strange decision - thankfully nothing bad ever started in Austria, other than some macroeconomic thought.

Portfolio Review

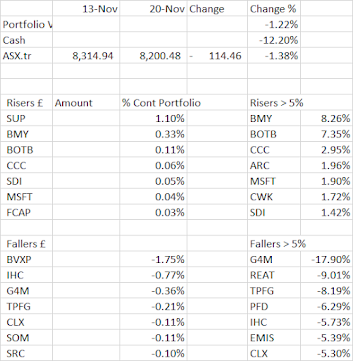

There were a few transactions and a few RNSs, but mainly it was watching things that had gone up come down and vice versa, with the downs a lot bigger than the ups.

G4M & PFD had results that were disappointing (especially G4M in light of the upgrade), but results don't seem to be the primary drivers for the risers and fallers.

I think the fallers are a function of sentiment or maybe the market just has it in for me - I may try and defend a couple - no offence to market participants.

As I said above, there has been stomach churning moves on companies up down & back up & back down - I am sure many people have successfully traded, but I take some solace from people reporting YTDs far more sporadically (and I expect the days reported tend to be after a good run).

Being Indian (origin) I am also thankful that you can put pretty much anything in our stomachs!

Lessons:

Maybe this is more a function of what is happening this week than last week, but more and more, I am OK at buying and terrible at selling. A solution might be to get better at selling but in the meantime, I do find the most effective way to deal with that is to try and find businesses that don't lend themselves to selling. Treading on future posts!

As a trailer, in explaining my incompetence, I might launch into a tirade about why value investing is fancy talk for the greater fool theory (like selling vol is fancy talk for buying the dip).

Transactions

Reduce (Sell) Inspiration Healthcare

- I was looking for an excuse to sell and this is one of my higher multiple holdings.

- Excuses are: Valuation, position size & director sales

- Not sure what to do with rump

Reduce BVXP

- Coming from the preparatory work on 2021 review, I think the adds were forced transactions to some extent.

- I certainly relaxed valuation risk and am probably paying the price for it somewhat.

- A reluctant sale in the context of a HODL but at the same time, in the context of valuation and short term momentum/risks, I felt there were better opportunities.

- Assuming I use low 20s as a cut off for high valuation, my exposure comes from Intercede Group (growing & so much Op Leverage), Games Workshop, Microsoft, Calnex & Bioventix (Special & worthy of HODL in my view), Gear4Music (undecided), EMIS (post IHC reduction, more willing to retain) and SDI (undecided).

Add Supreme

- One of the better opportunities I referenced and had room for in the context of position size.

- Last trading update, it was too early to draw conclusions - suggests come 7th December they will be able to draw conclusions - not sure how much seasonality but retail sales bode well & should have info on X-Mas order books by then as well.

- No doubt, given my run, they will warn or alternatively say in line & the price will crater.

Buy Premier Foods

- This is actually one of the strong performers from 2020 for me, purchased around 45p & added at 65p. I referenced a couple of items on the watchlist and this was one of them. Buying before results was not the smartest move, but without having skin in the game, these results are a tough read (tough even with skin in the game)

- When the pension was fixed, they talked about becoming a dividend payer again and I wanted to sell & repurchase for tax reasons.

- The story has gone exactly as I anticipated but price anchoring prevented the purchase side of the transfer (at a coust of around 14% and a small dividend.

- As far as the results during the week, market reaction obviously disappointed:

- Revenue 394m (down 6.5% on PY, up 7.5% on 2 yrs). Trading profit 57.8m (down 12.2% on PY, up 13% on 2 yrs), Adj PBT 464m (down3%), Net Debt 345m

- Q2 up on PY 0.4%, Branded 2.1% (2yrs 8.5 & 13.3%). H1 lower - the improvement on Q2 is a good sign re one off effects - Combined pension surplus - 20m in payments in half year - should be substantially reduced at 2022 valuation

- Firmly on track for expectations and feel free to read the results yourselves (it is a fair amount of work to decipher), but in short, this is a balance sheet that has transformed and a business that is starting to shift focus on higher margin branded goods & international growth.

- I think it is quite the stable of brands too - Oxo, Bisto, Mr Kipling among others and there is some credence to the fact that Q1 2020 really was exceptional.

- Given the balance sheet transformation and the brands strategy, I think there is a 30-50% upside just on multiple expansion (applying a conservative 14x) and the chance to own what I hope will prove to be a stable growing business.

- A lot is relying on where the new pension payments end up - was hoping for an ahead of and more of a clear case as to why this deserves a higher multiple - messy results & still issues on Balance Sheet make it a little trickier to assess

- As a defensive income payer, once the yield progresses I think it will attract income funds and at these valuations with on 1.5x Net Debt to EBITDA, might attract a PE bid (or even one from Nissin Foods).

- Think there is something about me, where I am more comfortable holding businesses that will not shoot the lights out and stay stable while the world is changing. At the same time, Bisto gravy is a good way to play the levelling up theme.

Buy Cranswick

- Everything I have read/observed about supply chain dramas is that companies that are vertically integrated have been better at managing these challenges. At the same time, again this is a boring income play that forms part of my 20 year sleep easy/income compounder holdings. It was another from the watchlist following sale of RELX.

- Very defensive, vertically integrated - Chicken sandwich wars - premiumisation & invested in capacity expansion

- Q1 Volumes up 7.7%, Sales 9.7% - FY forecast growth of 3.7% - bit of seasonality - assuming no lockdowns & whatnot - will people not buy a "shit ton" of meat - if there is a shortage of Pigs in Blankets - price goes up - they are vertically integrated in the pigs in blankets with their Bacon facility?

- Probably is volatile & subject to noise tantrums - but valuation has come in quite substantially - very boring company - think it got hit ever since there was the CO2 shortage - the actual report did not suggest anything untoward

- And now for a prediction which might be way off - in the last decade the world has gone cuckoo for pricing power - inflation is a general increase in prices - i.e. companies without pricing power can also raise prices?

- Also, looking at distributors/pass through entities, I think if you look at EBIT/Gross Profit, they seem to be pretty high quality businesses.

Portfolio Risers > 5%

BMY up 8.26% and BOTB up 7.35%

- No idea - could be anything, probably won't last - lots of angry people with BOTB (myself included!)

Portfolio Fallers > 5%

G4M down 17.9%

- Respecting the efficiency of the market by not adding last week was smart - clearly ignoring said efficiency was less smart. Half year results were not well received, in particular the downgrade to EBITDA following an upgrade a few months earlier.

- HY Revenue 64.7m - down 8% on PY, up 30% on 2yr (70 & 49m) - GM at 28% slightly down on PY, 10% improvement on 2 yr. - substantial margin benefit for GM with the much higher closing stock - 10% of revenues

- Operating leverage certainly going into reverse & higher marketing expense as % of revenue - prior year media advertising got very cheap & labour costs - up by 28% as % of revenue - some op leverage - but things getting more expensive - from 12% to 7% - that is a hit and a half

- Europe Q3 2022 slower than expected - Brexit related supply challenges - Europe down 16% on PY vs flat in UK - Metrics on the whole going in right direction - Europe should be significantly strengthened in Q422 & AV.com will also complete - guiding to at least 12m EBITDA (down from 14m) - share price reaction very reasonable in that context

- Profitable every month in H1, there is a level of seasonality supporting 2nd half - which is why this warning is potentially problematic - in light of European issues not being resolved until post Christmas

- Low margin business & coming under margin pressure - I have a few companies where the gross margin is pretty low - if inventory not converting to cash, there are a lot of payables? Cyclical business & I am not sure apart from graduating to better instruments, what the replacement cycle for musical instruments is & if it is strong/brought forward, it will slow down

- Europe - is it actually a temporary issue - international website visitors down 15% - have they lost customers they built in prior year as not been able to fulfil demand

- Interesting that the analyst forecasts were cut by the same amount in outer years - which could be lazy analysis or and indication that there is something a more permanent problem

- So that would suggest a poor result and also issues around predictability of demand and whether they have over ordered for demand that was brought forward.

- I think some of the other initiatives sound interesting and think there is quite a lot of optionality with the fulfilment business & market place businesses

- It was also interesting in the call that they talked about how they are more interested in pursuing profitable growth & retain gross margin even at the expense of sales & improving the marketing capability.

- On the own brand offering, 25% of sales from 6% of products (notwithstanding marketing push) seems a good sign for their own products.

- I did think of this something like a coffee can (but a growth coffee can) - again I am happier with Cranswick & Bunzl being coffee can stocks over Gear4Music or BooHoo, but each to their own.

- That said, I am willing to wait until the post Christmas update (albeit I think there is scope to disappoint)

- Last week this was an Add but reading the results, I think this also have benefitted from the perfect storm of high demand with cheap marketing & like BOTB, might be severely downgraded but like BOTB is likely a decent growing business & I have my doubts re the cyclicality (being larger & planned purchases)

- HOLD

REAT down 9.01%, TPFG down 8.19%, PFD down 6.29%, IHC down 5.73%, EMIS down 5.39% & Calnex down 5.30%

- As I say, maybe it is just me, but PFD aside, each of these are illiquid small caps, albeit IHC & EMIS have quite generous valuations.

- Personally, and I think this is a function of this week - I think a lot of fund managers who exhibited their amazing skills in these market conditions (previously market conditions did not allow them to deploy their amazing skills) are likely counting their bonuses and don't want something illiquid to damage their year to date in December illiquidity.

- Its interesting, the market has no conscience but it does have a calendar! At this point of the year, my year to date and how 2021 end up is kind of irrelevant (but I am an underperforming fund manager)

- PFD - I am not sure why the results were not well received - I thought the valuation alone would provide some support, but they are messy and I am often wrong.

- Just a word on TPFG - I appreciate housing bubble - delayed completions mean some people are renting longer, lack of availability ditto. I saw that rental inflation is actually quite high - this is a company that has revenues largely linked to such increases - As for the director sales, they happen every year (from the same director).

Additional Updates & Results

Very limited updates with limited information that I will cover quickly - not much to say - I wonder if RNSs had a higher marginal cost, how companies would use them.

G4M & PFD have been discussed above. FinnCap & Fonix were more interesting.

Fonix Mobile

- Positive start to the financial year - in line with mgt expectations - two partnership agreements with global payments platform provider & Venntro Media Group

- Venntro - roll out of carrier billing into 2500+ white label dating sites. Payment platform - provide carrier billing to their international customer base

- September - ITV Soccer Aid (significant contribution to 13m) following 0.5m with Ruth Strauss foundation - Children in Need - 8th consecutive year

- Progressed planned investment in technology & sales - several new hires - expand client base in core sectors & deliver new/improved products/services

- High repeat revenue, significant new platform partnerhsips, new supplier connections in international markets & growing pipeline of client prospects across all sectors - confident in growth potential - rest of year & beyond

- My last note, I talked of concern that they underinvested pre-IPO and the business would start to look less good and this addresses some concerns about opportunistic IPO

- HOLD - Liking this company & may well end up adding - not clear on technology disruption & seems a little too good as a business model though - but then they do exist

FinnCap

- Revenue up 55% to 31.7m (20.5m) - Capital Markets 15.6m (16.3m) & Cavendish up 286% (LUMPY) 16.1m (4.2m). Adj PBT 7.2m (4.3m) PBT 6.3m (3.6m), 3.54/2.96p, Cash 22.6m (higher post year end fee collection)

- Very busy year & strong - Deal & Advisory - hires in ECM, M&A, Consumer IB, Equity Sales/Trading/Research, Origination for Private Markets/PE, FinCap analytics launched - incremental revenues

- Q3 positive start, quieter than H1 on transaction volumes but issuance good. M&A pipeline strong but won't repeat current year - 45-50m Range Revenues, Compensation 60%, Other costs 10m - would suggest PBT at least 10m - trading at 10x half year - so H2 at half the level of H1 - conscious of disappointing market - dividend at least 1.75p

- Capital Markets - Client numbers & retainers stable at 114 & 3.2m, Transaction fees 8.7m down 20%, Trading Revenues 3.7m (up 20%) - one significant selldown - BOTB YOU SO&SOs!! - H2 equal to H1 would be an excellent result

- Cavendish - 35% of revenues from 4 deals that closed in period, full year revenue above 20m - timing of revenue recognition caused the jump in H1

- Building a financial advisory firm - servicing the needs of business of tomorrow is working

- New team hires - strengthen client service, origination & market offering, FCAP analytics making meaningful contribution to secondary commissions

- Investment in IT & Data & higher office costs (former to support FCAP analytics), higher marketing/travel expenditure, offset by lower introductory fees - 5.2m costs up 14% on PY

- H2 on H2 will be a material reduction, not sure how the market will react to that but I would suggest there is comfortable upside to revenue forecasts & then should fall out - fairly generous options schemes below PDMR & took pay cut/gave back - it is very fair - they spoke about culture

- Based on what they are suggesting - Retainers flat, Transaction down 10%, Trading down 20% - I make it 51m Revenue

- With the cash receipts post period - should be around 27m Cash - Balance sheet is fine - sensitive to market cycles so multiple needs to compensate - it does! 30% M/Cap in Cash - 10x diluted HY Adj EPS - everything they are saying about building a business is true - impressive management team

- Call it 75m M/Cap to allow for dilution margin of safety - at 10m it is 7.5x - they have managed to grow revenues every year because they are building a multi-service business - they have done a lot in 10 years at 7x multiple & 5% yield

- HOLD to ADD - Illiquidity & volatility considerations but room for a little more - Cash available in SIPP from BVXP reduction

SHED, SUPR & PHP

- SHED: 200m equity raise, 5% premium to NAV, 5% discount to share price - 170p, 7.4p target dividend - 400m pipeline - 5.4% NIY, 8.4 yrs Lease term - along with SUPR, certainly my favourite overvalued REIT - Movement to Premium List might drive premium appreciation a la BBOX/WHR

- PHP: Acquisition, west sussex - 5.38m - GP Practice & Pharmacy - 14 yrs, accretive to Vault and no infromation on NIY - Well: 10.3m Euro - Rent roll over 138m to almost 139m, 5m - Rent roll over 139m, 5m Rent roll over 139m - still be quite a wide range but imagine we are talking sub 4%

- SUPR Two acquisitions: Sainsburys Swansea & Tesco in Maidstone Kent - 73m & 4.6% NIY Sainsbury - standard with online fulfilment - refurbed in 2016 - 7 acres - city centre - 27 year term, upward only open market 5 year reviews

- Tesco - refurbished 2007 7 acres + some other units - town center location - probably requires some work including potentially building some online capabilities - 13 years - open market upward only rent reviews

- HOLD, HOLD/SELL and HOLD

GAW, BNZL & ULVR

- GAW 35p dividend - no information on PBT of at least XXX, but dividend higher than PY YTD

- Strange for them to provide the dividend comp (surplus cash ahead given CapEx sounds good) and not the trading comp (do mgt care about the share price after all?

- Trading information would have supported or destroyed the share price.. If I am looking at it with rose tints - they didn't say at least because of logistics issues and they don't know what will be shipped/timing differences. More cynical tint - they don't want to tell because it is not good news & current share price reaction tends to the latter tint.

- HOLD - This & BVXP - maybe problematic short term but they are pretty special companies & special companies are worth HODLING

- ULVR Disposal of Tea business - Sold to private equity - focus portfolio into higher growth spaces - €4.5bn cash & debt free for business with 2bn in revenues - Sold at 2.25x Revenues - 4% of Sales / 4% of M/Cap - should be slightly margin accretive given 15% margin in Foods/Refreshments vs 18% for the whole business

- HOLD - Interesting what Lindsell/Train would think about this given they find it ultra defensive because of the number of brands/breadth of the business

- BNZL Acquisitions: Two acquisitions, both in the UK - Durham UK - personalised workwear/promotional clothing (29m in Revenue) & Buckinghamshire - Hydropac - distributor of insulated packaging solutions 7m revenues (food delivery market), complementary to Coolpack business in Netherlands

- HOLD - Doing what it should

And Finally

If I actually published this at the time I intended to (it is a lot less fun writing this when the market is handing your ass to you with some elaborate salt spraying), this comment would have been prescient (even though it is delivered in jest).

The ECB seems pretty confident in its views on inflation and their strategy will be effective. If I was going to back my view or their view, I'd be inclined to go with them over me, but like when your portfolio is getting decimated, things can always be worse.

So as we approach Thanksgiving and complain about 1st world problems like monetary debasement, we can be thankful that we are not Turkey (the country or the bird).

Adieu

Comments

Post a Comment