January Week 4 & February Week 1: Portfolio Review

⭐#AIR #ARC #IGP #BMY

💩#SUP #CLX #AAZ #FCAP #SOM

Transactions: Buy #BAG, Add #SOM Reduce #SDI Sell #DUKE

Updates: #BAG #TPFG #IGP #GSK #CWK #SPSY #CCC #ULVR #FNX #CMCX #BMY #SOM #AIR #AAZ

Portfolio Review:

I did say that Monday was ugly, but all things considered the two weeks were not all that bad - mainly thanks to a takeover offer for Air Partner.

Reasonable set of trading updates - Duke exits, SDI is materially reduced & AG Barr enters.

Lessons:

So on Monday in peak dramas, I sold Duke & SDI with the proceeds used to purchase AG Barr.

Ignoring the merits of the decision, the sells were selling at the worst possible time.

The reason is I started having doubts / losing confidence (with SDI almost exclusively quotation risk but also director sells) and the dramas on Monday reminded me of that.

While the impact is immaterial (for now), it is poor execution and I need to be better at selling without needing the volatility (down market) to remind me.

Need to realise I am not comfortable with the drawdown before the drawdown happens!

Transactions

Reduce SDI

- Confidence reduced following director sale - telling that after announcement and the announcement had much less impact on earnings estimates / share price (which maybe a market factor)

- Reduce valuation risk in the portfolio.

Sell DUKE

- Reduce risk in the portfolio - getting nervous - high dividend on declining fair value (really ought to be at amortised cost) - concentration risk in their portfolio is increasing / very retail heavy investor base

- Not sure I will come back to given concerns about accounting.

New AG Barr

- Ex holding and a permanent watchlist item - regret not buying this in 2020 (only 10% on trade vs 40/50% hit to share price at peak drama)

- Very high quality/defensive sleep easy - dare I say coffee can.

- Mgt emphasise this is a growth business - think the growth is somewhat hidden with Rubicon energy & funking (Monster/Fevertree) & Moma foods.

- Quality is without question & valuation is reasonable especially if I am right on the growth thesis.

- Following my purchase, they provided a positive update to the market

- Revenues 267.5m (up 17.5% on PY 227m & PPY 255.5m - 234.5m ex Rockstar) - Barr & Funkin traded well especially while restrictions were eased

- Inflation impacting (as expected) - cost actions & pricing to mitigate impact- - Adj Op Margin 15.6% (14.8%) - marginally ahead of November guidance - good

- 66m net cash after investment in MOMA foods - excellent performance in volatile environment - further invest & growth

- HOLD - Happy for now

- Notwithstanding the lesson above - I sold DUKE to buy this - reported same day - reticent about opening one & not other (no reason) - maybe it was stupid selling while on sale, BUT You do You!

Add Somero

- Share price pulled back after a very solid update - in my portfolio assessment, this ranks quite highly and has been an add for a while. Only concern is, am I chasing because was not able to add earlier in the year when it dropped for no reason.

- Upgrade - strong Q4 & December particularly - everything upgraded $133m (up 50%), Adj EBTIDA 48m (up 83%), Cash $45m (up 18%) - Previous $130, 45, 39

- Guess there is a lag on cash because of the strong December, but cash has outperformed EBITDA in the upgrade

- 3 new products (Sky strip (remove structural shoring plywood), boom screed (mechanical tilt panel casts) & next generation boomed screed

- 1.8m & 3.2m in H2 & FY from new products (PY 2.2m). Skyscreed improved on H1 0.7m (product demos) - significant opportunity in high rise market - measured progress in penetrating it in 2022 & beyond

- US strong, H2 better than H1 - $105m revenue (up 50% on PY) - conditions positive - extended project backlogs carry well into 2022

- Europe, H2 similar to H1 - $12m (up 40% on PY) - similar to US but not quite as good - should have more recovery

- Australia, H2 up on H1, much bigger than PY H2 - revenues up 5.5m revenue (up 450% on PY) - direct sales team & currency benefits - meaningful opportunity for growth from new products

- China, H2 down on H1, revnues $2.6m (down 30% on PY) - retracting from the market - will support customers

- ROW H2 in line with H1, Revenues $5.8m (up 39% on PY) - seems like a special mention of India - US tend to be early adopters & rest of world follows

- Boomed Screed start product - Large warehouses - $63m in revenue (up 100% on PY)

- 2022 - Modest revenue growth, & ADJ EBITDA comparable - investment in resources for future growth (same as they said last year) - US strong & positive in Europe/Australia/other regions & new products

- Long term - Product development, Sales, Customer support - expand addressable market with new solutions for application / different marketsEx holding and a permanent watchlist item - regret not buying this in 2020 (only 10% on trade vs 40/50% hit to share price at peak drama)

- Still can't get my head round longevity but nothing here to make me want to sell - will probably get a big special dividend

- HOLD - Feels a little too good to be true - Is it PI crowded?

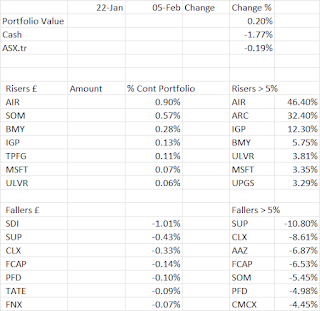

Portfolio Risers > 5%

AIR 46.4%, ARC 32.4%, IGP 12.3%, BMY 5.75%

- Air Partner - received a takeover offer from Wheels Up - wasn't sure if this was a trade or an investment - trade it is. Really thought about adding this in falls but rule was that it would not be a trade that turns into an investment - luckily I didn't sell - that would have really irritated me! Nice to have a price floor in the event of dramas.

- ARC - No idea - probably is ridiculously cheap - guess these moves are the wonder of illiquid microcaps.

BMY 5.75%

- Far shorter update than Somero but pleasing nonetheless - Revenue comfortably ahead (197m) & PBT materially ahead (20.1m) - trading strong in Consumer for Adult & Children

- BDR 15m Revenues & 5m Profit milestone reached (6 years) - with acquisition - enhance offering of BDR & accelerate academic publishing in N America (Interesting)

- HOLD - Really wanted to add in the ructions but had to be disciplined - DumbAss!

IGP 12.3%

- IGP had a contract win with a Federal Agency- seemingly good news but already in forecasts

- Initial order, will hopefully increase number of licenses - smartphone access - 20k devices + support - $500k

- Liquidity & certainly not cheap, even with the pullback - room to add ex-liquidity

- HOLD - Very undecided - If I was price insensitive, I would add - sector tailwinds/margins - not sure about the growth.

Portfolio Fallers > 5%

SUP -10.8%, CLX -8.61%, AAZ -6.87%, FCAP -6.53%, SOM -5.45%

- Of the above, the only one with any news was Somero - the rest I am putting down to market wobbles / illiquidity.

- AAZ announced the completion of their investment in Liberto Copper (which based on Liberto Copper share price appears underwater)

- Specifically, I did think Supreme reached a false price - why I didn't sell/reduce into the false price - think that might be a reverse of the selling post reminder lesson.

- Bit of a shame, because there were plenty more updates during the two weeks, so would have been nice to have covered some of them here.

Additional Updates & Results

As I said, I was overwhelmed during the week with the Monster Tech, the volatility and all the other reporting that took place, so here goes:

SPSY

- 500k contract win with lottery customer - over 10 years & increast in covert materials order from CB by 25% (75% of PY)

- Sensor contract renewed at nearly double original value - service delivery will overlap with development/deployment of next gen sensors - $700k additional revenue not in forecast - maybe add 20% to earnings - 140k / 2% to forecast - nothing big but progress

- HOLD to REDUCE - Do feel if I cut now, I would lose patience at the wrong time!

CCC

- Q4 ahead of expectations - Adj PBT at £250m - 17th year of earnings growth despite strong £ & shortages

- Revenues up 23% (27% CC) including acquisitions, Service revenue - strongest growth in 20 years (very interesting!), technology sourcing strong & broader than 2020

- £241m net cash & higher inventory than normal - carried extra to manage shortages - strenght of Q4 gives encouragement for 2022

- Product order backlog at record & considerably higher than year ago - early (& buffer?) ordering + strength of underlying market - hopeful of repeating service revenues (won't grow?)

- Much to do but growing in multiple geographies across products & services - another year of progress.

- HOLD - Very comfortable long term - Not ex-growth but growth is rolling over & probably will go ex-growth - nagging feeling I am late to the party on this one and potentially better opportunities at moment.

ULVR

- Change in operating structure - no matrix/regional dramas - 5 business lines - Food & Refreshment - renamed to Nutrition (new world foods) - Beauty & Wellbeing, Personal Care, Home Care, Nutrition & Ice Cream - Focus on growth, responsiveness/agility & create accountability

- Cut 15% of senior management, 5% of junior mgt - "lean" corporate centre driving strategy & business operations/supply chain - central support - 1500 roles cut (more expensive folk)500k contract win with lottery customer - over 10 years & increast in covert materials order from CB by 25% (75% of PY)

- Been working on it for a year - BS - you come up with more than name changes in a year - like what the impact of the changes will be on costs & better words than "around"

- Sell to Hold - Been through the absolute ringer and down less than 5% YTD does have a certain appeal!

FNX

- Payment volume up 12% to 138m (HY21 123m) - new customers in all sectors - 116 active customers (HY21 2015, FY21 111, 34 signed in the year)

- Gross Profit ahead of mgt expectations, Adj EBITDA comfortable ahead of mgt expectations.

- GP up 20% to 7m (HY21 5.8m), ADJ EBITDA up 20% to 5.5m (HY21 4.6m) - increased interim dividend 75% of Adj EPS

- Leading provider for charity telathons (several new clients in period), Payments, messaging & managed services each grown & growing pipeline into H2 - Confident in growth potential 2022 & beyond, optimising margins by focusing on more profitable product offers - progress on international - announce significant developments later in year (FY 2023 I expect)

- HOLD to ADD - Getting more comfortbale - have managed to maintain margins while supposedly "investing" for growth - don't follow the technical requirements but feels like quite a lot to like - customer concentration/tech risk

CMCX

- Active clients remained similar to H1 2022 (53k leveraged, 185k non-leveraged), AUA/AUM CLOSE to Record Highs - investing in development of UK non-leveraged

- Confident in underlying performance - long term business growth & value - confident of achieving Operating income in 250-280m range

- Certainly got the cheapness if you allow for "investment" in UK non-leveraged business - could be a waste if market/retail dies

- HOLD (just) - Was expecting an ahead (big range & unpredictable) - seems moody compared to prior year & not much detail

CWK

- Acquisition of Grove Pet Foods Limited - dry dog food producer for private label & own brands - Terms not disclosed - Immaterial

- Enter pet food, grow the business/products & some synergies. 20m revenue up 30% to 21m, GM 30% (stable/up), OpM 10% (up substantially) - Managed to deliver higher gross with similar cost base - looks pretty clean - some related party loans & impariment in 2019??

- Maybe diworsification but does not feel like it - I wanted exposure to Pet sector - must be some synergies & Grove foods benefit from distribution

- As far as trading is concerned, Robust & comfortably ahead of Q3 2020 - well executed X-Mas plan - unprecedented challenges & widespread inflation well managed & mitigated - cost control & ongoing recovery

- Far East lower (Lower prices & Norfolk export license ban) - pig supply exceeding capacity - working with & processed more - lobby govt - skilled butchers & China export

- Premium breaded poultry - 31m on track for new financial year - building new business pipeline for this - outlook in line - debt build up, balance sheet is fine

- Infrastructure & customer relationships, breadth & quality of products - stand by the inflation play - higher gross profit put through the capital base

- ADD - Been thinking about adding for a while - happy to let it be bigger position - this makes me more willing to add - Coffee Can?

GSK

- VIIV Healthcare - own 78% - HIV company - settlement with Gilead - $1.25bn upfront & 3% royalty on sales ($6bn - $6m)

- Upfront distributed to owners - contingent consideration for other owners also goes up - will all be adjusted out - market don't care - assume known

- SELL to HOLD - More sell than Unilever - Circle of Competence

TPFG

- Group Revenue 24.1m (11m) - LFL increase 26% & 29% vs 2020 (13.9m) & 2019, Network income 157m (94m), 17 & 18% LFL (110m)

- Mgt Service Fees 14.7m (9.4m) - LFL increase 19% & 16% vs 2020 (11.2m), EWE 167 under contract (6 in Q4, OK), Sales agreed 26.3m (2020: 27.3m, Q1-Q3 - 31, 29.2, 28.2)

- 591 offices (38 new, 209 acquired with Hunters), 74k rental properties (58k PY) - 2.7m Net Debt (12m borrowed for Hunters) - Start hybrid model for Hunters similar to Ewe

- Growth levels are starting to rollover but H2 2020 things had started to recover and become more buoyant - sound confident - increase market share (saturated market - UK real estate - probably!) - Fall of in sales agreed pipeline is better than I thought, but won't replenish like prior year

- Have been able to assist franchisees, Hunters full year / financial services & larger installed base / inflation will deliver growth offset by a slower sales market

- HOLD Tempted to trim a little due to illiquidity / position size concers but no reason to otherwise - valuation still very reasonable - I'd expect growth in 2022

And Finally

I updated my portfolio assessment tool and am very happy to say that CoVid sensitivity has been removed (and replaced with Supply chain/Inflation) - much like Russia/Ukraine, I am not really sure how specific this is and therefore how useful it is.

Guess that is one of the reasons I am trying to reduce risk somewhat.

But on a happier note - we seem to (at long last) be moving on from CoVid and doing it faster than the rest of the world with a lot less protesting & some pretty severe boundary pushing when it comes to civil rights.

Loathe to say it (and I still don't like the Gentleman serving as Prime Minister, nor will I vote for him), but credit where credit is due.

And of course, well done to us!

Adieu

Comments

Post a Comment