March Week 5: April Fools

Public Service: The Tyranny of Merit

Markets/Macro: Not my fault!

March Week 5: Meh!

Transactions: Add #MONY #SDG Sell #AIR #MRK

I read a book and I don't even have to write read in inverted commas (started of as "say read" - that was wrong, I am writing - write read - very strange).

Probably need to go back to that English GCSE.

Anyway, the book is called The Tyranny of Merit by Michael J Sandel.

It is very interesting and only 230 pages (less if you include blanks).

Talks about how the shift from a discriminatory society to one based on merit, while having advantages leaves behind a lot of those that cannot compete and are left feeling as if they failed. Apparently it is easier knowing you didn't get ahead because of racism compared to your not being good enough.

Not sure I agree with all of it but I expected to be thinking what lefty liberal nonsense is this and I most certainly didn't feel that way.

Certainly made me think a little about my own tyranny - someone who courtesy of their parents were railroaded into passing exams & managed to do OK, but was it worthwhile.

As the risk manager in Margin Call says - how many people would have crossed the bridge he could have helped build in stead.

At least I don't have to feel that bad, since I have no practical skills to offer less tyrannical pursuits.

For what its worth, I do think there is societal value in helping people/businesses save for their futures, help finance their present & help manage their risk.

Unfortunately, it often veers from helping people manage their risk to helping people bet on the risk, all in the name of helping people save for their futures.

On a brighter note, I just started "reading" Discord by Helen Thomas - I expect to learn that the tyranny of power is far more tyrannous than that of merit!

Cursory Market/Macro observations:

Honestly, I am so "beep" bored with all this inflation / yield curve / inversion / bull(shit) flattener / stagflation / super cycle / transition / energy and whatever else.

Besides, nothing anyone can do - it is Putin's price hike in USA, it is transitory inflation all because of Putin. Again, wouldn't take the word of Madame Lagarde as gospel.

I understand that EU imports of Russian gas have been on the rise in March.

At this point, I am tempted to reference an earlier blog:

"it is pretty rich of policy makers to blame (albeit wholly predictable) Economics for the policy decisions they took."

Replace Economics with Putin.

On a non market note, that inflation is starting to impact no? Might need to go back to better rewarded tyranny, or maybe a job I enjoy (be a shame - have loved freedom from the Man).

Things a bear market will make you do hey!

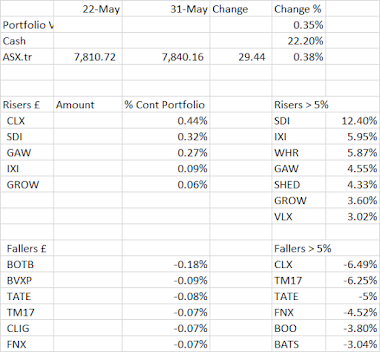

Portfolio Review

Quite a few updates during the week and a decent showing from the portfolio, with Bloomsbury & TPFG being quite large holdings and rising. Bloomsbury with good reason & TPFG I expect good anticipation.

The week finished up 1.06%, versus the all share at 0.86%.

On a quarter to date, or a quarter and one day as it turns out, the total Modified Dietz return

(Sharepad can explain, I just think it is time weighted)

is at -1.7% vs All share ex Investment Companies at -1.4% & the all share which is at -1%.

I will actually settle for that underperformance, not because I am devoid of ambition (kind of am), but the sectors driving the FTSE All Share are just not present in my portfolio and not how I invest.

If I pick some poorly performing fund managers at random, who are similar in approach & also world markets, I can enjoy my relative lunch.

I think one of the reasons it has held up is the bath I took in H2 2021 - one of the benefits of that bath was that I got a bit more circumspect about valuation, which is shielding me a little in this bloodbath.

Lessons:

Marks was a lesson in how to assess management - perhaps I was a little unfair on them and taking out my anger on my mistake on them.

That is emotion - emotions are stupid - they don't even understand logic!

Also, at some stage, you are going to stop basing trading activity on ex-dividend as the prompt!!

Finally and a more interesting one - I look at the strong performers and think Oh if I hadn't reduced / if I had bought more and why I didn't do that. My first purchase of Bloomsbury was around 1.80, TPFG around 1.70 - clearly they were screaming buys.

Problem is I did not know they were screaming buys at the time they were screaming buys. Because they were screaming buys (with hindsight) 24 months on, does not mean they are screaming buys today.

Yes I am talking about you BOTB!!!

Risers & Fallers > 5%

This section will be much shorter (watch the space for other changes).

Feedback received - blog is too long. I think the feedbacker was too kind to say repetitive!

BMY - Strong trading update

TPFG - No idea, positive week & anticipation of results

CMCX - No idea, a little disconcerting given 31 March when the fall started, when people see numbers or maybe some risk management blow up. Kind of regretting switching IGG to this on valuation grounds.

SUP - No Idea.

IGP - Update - contract renewal, no growth.

MONY - Ex-dividend one would hope.

Transactions:

AIR - Sell

Left the portfolio - takeover proceeds received very promptly I must say, which kind of screwed my cash planning a little, but not the worse problem.

MONY - Add

Investing Air Partner Rightsizing and thought it was looking set to bounce - ex-dividend prompted transaction - replace Air PArtner - similar value/income/quality characteristics. Note this is a recovery trade, not buy & hold (ex-growth).

Stop buying things just because they are going ex-dividend (was planned, dumb as it looks at moment)

SDG - Add

Investing Air Partner proceeds, similar in terms of size/quality/valuation. Technically admin transaction to move to ISA but feel this is one of my favourite holdings for fresh cash at moment given quality/brands, business momentum & valuation (cyclical risk notwithstanding). May well not do other leg pending results, but more than full sized as things stand.

Updates & Results:

IGP

- $3.4m contract renewal - exactly same as last year - i.e. no growth. Not sure it is particularly high growth, which is what you need for Op Leverage to kick in.

- Unsure about this one, technically does not fit M/Cap criteria. If growth with that margin, could be wow (Big IF).

- Cybersecurity/Identity/Surveillance/Govt security is a positive environment, solid balance sheet/profitable - probably one that should have held up but been selling a while before conflicts

- Hold to Sell - Probably a hold especially in context of why bought but tax benefit to selling now - but then can't buy for 30 days, which may include a trading update. Chart suggests update won't be amazing

- Update: Sold this on Monday

- Lost all momentum - if the growth comes amazing, but not sure we are seeing that yet - hopefully buy back cheaper in 30 days time

- Next day - profit warning - should not have been done that way given contract renewal announcement - very Ixico (including the price action) - outside criteria & dickheadedness - unlikely to return.

SDI

- Acquisition of SafeLabs - produces fume cupboards & such like. £7.7m consideration. 4.8m Revenue 0.9m Adj EBIT. 10x PBT (more expensive than they have been) - 20% margin is pretty decent. Earnings enhancing 2023.

- Incremental return is 12.5%. Similar to Monmouth in 2020 - will operate the two as stand alone entities. Owner/Manager stays on - has 41 staff - will be part of sensors & controls division

- 5.5m Upfront + 200k in shares (1 yr lock up) + Net Asset value - freehold manufacturing site + cash is 1.9 of 2.9m Net Assets. 500k on 3m Equity is a decent business

- V Small position now - not regretting selling this but probably regretting not buying back when it got to sub 20x (best one can hope for). Like their last two acquisitions & many reasons to hold - Mello chat with Mark Simpson & Kevin Taylor on Judges was interesting.

- Hold to Add - Valuation aside and not sure if the environment is quite as fruitful for private to public multiple expansion (especially is the multiple spread is tightening)

BMY

- Another upgrade. Revenue comfortably ahead of expectations (£212m) & PBT materially ahead (£22m) - did say they would be materially ahead, didn't expect it twice

- Performance demonstrates strength/resilience of business & execution of digital/acquisition strategy. Feb sales exceptional Sarah Mass - Crescent. Been flexible re when/where print to manage supply chain issues

- 4 titles published in late Jan/Feb 22 performed very well with backlist continuing (Consumer division). Non-Consumer - steady beaten 15m/5m Rev/PBT target in 2022

- BDR new era of growth - acquired ABC-CLIO - digital resources in US High School libraries & added US Drama TGC Books to Drama Online platform.

- Hope the BDR growth delivers because the consumer is cyclical/hits business so will be very impressive if they can repeat year to Feb 2022

- Would have thought two materially aheads in 3 months would get more than 10% YTD but understandable given 2022 "Hits". Frustrating that market chooses to be rational with my shares!

- HOLD - Position size has prevented adding (thought about it multiple times) - LESSON ABOVE!

SHED

- 72m in acquisitions, 4 properties. NIY blended 4.6%. London 28m (1st acquisition there) at NIY of 4.2%, immediately income producing. NIY since December fund raise circa 5.4%, Trending Down

- HOLD to SELL - Having the same issues with this one as the other ones but everytime I sell an overpriced REIT, it carries on going up. NIY 5%, NAV Premium 10%, Yield to me 4.5%!!!

- SOLD on Wednesday - Better expected returns elsewhere.

TATE

- Acquisition of Chinese prebiotic dietary fibre business Quantum HiTech from ChemPartner for 237m$. Food for the probiotics good bacteria - getting pretty early in the food chain!

- Engages in Fructo-oligosaccharides & galacto-oli….des (sucrose & milk) - 25% of dietary fibres, growing at 6% (10% in China). Can add added fibre solutions for the customer.

- Completion Q2 2022 subject to approval by ChemPartners

- Adds new/complementary products to portfolio, add presence in China/Asia. R&D/Process expertise. Accretive to revenue growth & EBITDA margin in 1st year

- Guess it is in line with the strategy. China risk but pretty sure if energy is excluded, food will also be excluded from any dramas

- HOLD - Happy with position size, not sure how market will react to China - either way want to see the balance sheet post commodity disposal before taking further action

BVXP

- Revenues down 8% to 4.73m (5.16m) - PBT down 4% to 3.5m (3.7m), cash 5.1m (5.8m). PAT 3m (3.1m), EPS 57.35, Diluted 56.79 (59.5 & 58.8). Dividend 52p -

- FX 200k swing helping PBT & Working capital 800k helping the cash generation. Adjusted (which I did last year), PBT is down by 10% & free cash is close to 3m

- Vit D - plateauing as expected, 1.3m revenues no longer coming (which covers bulk of the fall in revenue I think). Clinical diagnostics markets still challenged due to pandemic - should recover.

- Price erosion (that's interesting - healthcare costs are holding inflation down in US) for end customers means demand for antibody hungry assays is reduced

- Troponin increased significantly (same wording as PY), which was a double - from 0.75 - could have replaced the lost revenues pretty much by year end and then growth

- R&D - 2 projects awaiting news in 2022, TAU biomarker is promising awaiting news in 2022, Pollution assay 1st field trial & adapting & more trials in 2022,

- THC Cannabis Sandwich antibody starting to commercialise & progress on Vitamin supplement interference (antibody identified)

- Results aided by FX & working capital otherwise would not have looked as nice - remarkable company - 93% GM 70% EBIT, 65% ROE in 6 months! 33% ROA in 6 months! All the re-investment in the P&L

- Personally, didn't think the results were that great but could get back on upward trajectory. Surprised it doesn’t fall or did but buyers came in force - Makes sense - assuming longevity & given quality, could argue it is cheap

- Hold to Add - Want to buy in the low 20s, was hoping these results would give me the opportunity - feel the great days are behind, although green shoots for good (maybe great) days starting again. Not Selling!

BAG

- Revenue up 18% (2yr 5% & one extra week = 6m, 4,5m brand support & 1m Moma) to 268.6m, PBT 41.5m (up 62 & 11%) & 15.6% margin (up slightly). EPS 25p down (increase in deferred tax liability), dividend 12p (10p final). Cash conversion >100%, 68m Net cash (10% of M/Cap)

- Gross margin 118m 44% up 2% points on PY from 97m, Operating margin 15.6% (up slightly) PBT ahead of 2019, which included Monster energy - impressive - all brands in growth - Barr soft drinks focus on energy & Funkin - establish position.

- Soft Drinks - Market grew 8% in value & 2% in volume (pricing power?) less discounting. Due to data capture, their value share (maintained) is not reflected. Growth in England/Wales - multipack formats

- Cocktails - strong recovery & pent up demand - growing area in hospitality 15% drink cocktail weekly - RTD 500m market with cocktails shade under 20%

- IRN BRU - 17% growth (5.5% 2 yr), Rubicon - 40% growth (26%), Funkin - 118% growth (92%). Energy in general & Rubicon Raw Energy (juice based - must be healthy!!). Funkin is a leader. Moma - talk about oat milk.

- Multi brand beverage portfolio - will acquire remaining 38% of Moma over 3 years

- GM improvement pretty impressive given inflation - note - extra revenue of 4.6m from brand support activities - probably flat in reality, some benefit from right sizing following loss of Monster/CoVid

- Operating costs up 25% on PY - in line with increase in volumes, LOGISTICS and higher marketing investment (seems so different to what Unilever are suggesting)

- Incremental cost savings identified over year helping to mitigate inflationary impacts - CapEx dialled up (dialled down during pandemic) - efficiency & growth initiatives + ongoing maintenance

- Barr Soft drinks (85% of revenue - 228m from 210m) - margin improved 2.5% to 45% - volume & mix, less discounting. Rubicon Raw Energy & Spring strong contributors to margin/revenue growth. Slow& steady, guess hard to grow Irn Bru given positioning

- Strathmore - reopening benefit but very high costs of glass - more environmentally friendly (other than the blast furnace producing the glass, but details!)

- Funkin - 36m in revenues, up 19m - GM improved by 10% (4% increase) to 40% - nice & if growth area & margin progression - less dilution of group margin

- 34m increase in asset base - 18m is cash, 10m Moma & extra working capital (timing receivables & higher stock). 31m free cash (approx) and 6m Capital Investment - Dividend - target 2x cover & 50% of free cash flow - so with the extra CapEx - the growth is likely not going to be all that

- ROCE over stated due to lower CapEx in current year (19% vs 15% but that was understated) - and the impairments have reduced capital employed!!

- Largest customer takes 20% of sales, no others < 10% - suggests there is a clear market leader in Scotland supermarkets, ROW, while tiny at 5% is showing decent growth - Ireland - but they had very severe lockdowns so more recovery

- A pleasure to read the results & such clean reporting - absolutely nothing to worry about & may well be some "hidden growth". That said, I remember it being cheaper, although has re-rated 10%

- FY - Funkin & Energy probably growth drivers + extra 5m from Moma - 285m maybe & flat margins - 42m PBT & 34m PAT - analysts have it at 280m & same numbers elsewhere

- HOLD (maybe Add) - all the right noises - quality, quality, quality and hopefully growth. I remember it being cheaper (probably a relative thing), but was a QARP purchase & still is.

And Finally,

As I mentioned in my year end review, 5th/6th April 2022 is the 10 year anniversary of my investing.

Now, last I checked the Earth completes a rotation around the sun, whether I invest / measure my performance or not, but as we all know, the one thing markets definitely have is a calendar.

The first purchases were actually on 25th April 2022 so I am debating what measurement period to use (of course I will be using the one that looks best), but the target annual return is 7.2% and has been so selected because it is easy to apply the rule of 72.

If anyone can tell me what 7.2 years is in real time without a calculator, kudos!

Over 10 years, the Modified Dietz Return is 90.4%, so a little behind where I'd want to be and roughly 5% behind the All Share and about 6% ahead of the All Share Ex Investment companies. *

If I use an All Share ETF (FTAL) with a 20bps fee or 0.2% (what the finance profession has against decimals is beyond me), knocks at least 1% between the All Share & the ETF equivalent. *

If in stead of SPDR, you went for the X Trackers (XASX - ESG baby, for only18bps - no material / oil and gas), I'd be about 20% ahead over the 10 year period. *

Fees matter and much like life partners, choose your passive investments carefully and be careful with the Xs!

Adieu

* Excuses calculation: (Portfolio Value - Benchmark value)/ Total Cash contributed - which is horse crap when using Modified dietz, but what else would you expect from me!

Comments

Post a Comment