H1 2023 Review: Exciting Meh!

Performance: -1.8%

Performance Chit Chat

Top 5s

Musings

Narratives

And Finally

Hello Everybody,

Apologies for the delay - but never late than never as the tardy like to say. I would have done it sooner but the Men's Wimbledon final was way more exciting than I anticipated - seriously who is that kid!

Anyway, I am sure you are missing all the Half 1 reviews, so here is one for the road (or H2).

So why have there not been any posts in 2023 or at least a cursory Q1 review - usual reasons - this blog exists as a record of me having completed my to do list & said list was incomplete.

At least this time it was laziness & some pretty awesome vacationing.

Really think the world has it backwards:

I can attend meetings & pretend to be busy, when I am 65, AI notwithstanding. Trying to kick against those currents at Johnny's Gorge, much harder at 65, medical enhancements notwithstanding.

As far as markets are concerned:

Considering I sold Microsoft in February and used the proceeds to buy 2 year treasuries, I think it is fair to say that I got my market call completely and utterly wrong.

Which is especially disappointing because I think on the whole in terms of macro / systemic events - I think I would give myself a decent score - hindsight biases notwithstanding.

On this front, I think the main thing I got wrong was multiple contraction in the face of higher interest rates - but all this relies on knowing whether the starting multiple is close to fair value, which is best left to the DCF Bros.

On the other hand, my being wrong has nothing to do with me & it is just 7 stocks driving the market higher because they are the biggest and that is how Brrr Brrrsssss!

More at narratives.

H1 2023 Performance

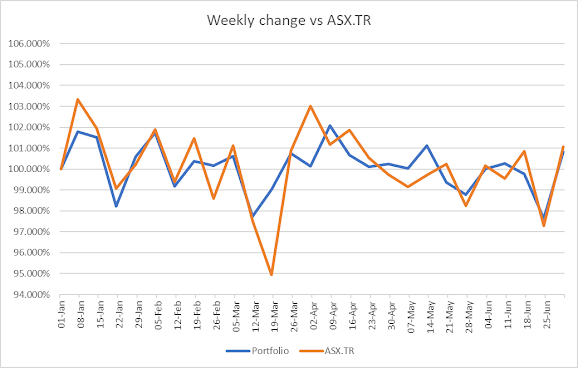

Sharepad tells me modified Dietz return is -1.8% & about 3% behind the All Share total return - I am inclined to trust this over my own numbers.

I expect the difference above is because I have adjusted cash additions in the blue line but not in the yellow line.

Dividends received approximate to 1.5% of the portfolio value.

Sharpe readers (geddit) know I expect to underperform on the upside & outperform on the downside & it looks like I just about achieved that.

Although, January when all us UK investors were having a great time, I had two warnings - Spirent & Direct Line (shocking!!) but I didn't care that much because I was in Thailand.

My tweet in late Jan about omnipotent central bankers making it clear that bailouts are available to all professionals charged with managing risk:

And then March happened!

Perhaps, I should have been more active but I was busy having fun & not sure I really noticed.

Did see that they announced the Bank Term Funding Program - But the ******* Put!

Its enough to make an embittered bear think they are trolling!

But this bailout, like all previous bailouts, was not a bailout!

Would I have done better if I was more active - who knows - more on this in the musings.

I started the year with 39 holdings & finish at the half year with 42 holdings. Cash has been added as is usual in the new tax year & some moving things about.

Clearly, being one of those diversified have fun staying poor types, I am destined to be an index tracker, even with what I am fairly certain is a sizeable active weight versus the index & now that it includes bonds & gold within that, it is even more active!

The biggest losers did not hurt the portfolio as much as the price performance would suggest - FCAP was tiny, UPGS bought at end of half year, with Liontrust & Calnex sold and materially reduced before they caused too much damage, although I am giving Liontrust the opportunity to cause that damage in H2.

Same on the winners - Time a very late addition, BILN, TPFG & AOM small holdings.

For anyone interested, all the transactions in the 6 months are at the end of this post.

Games Workshop hurts the most - having sold smartly & less smartly, I was left with a smallish position that needed dealing with - I have multiple instances where I say this is a buy, most notably from a FDEV warning, where I said yet another buy signal for GAW.

Then Amazon royalty & we're off like Nvidia before AI - really need to work on that price anchor.

At current value I struggle to add & for all I know I would have been spooked out in the strength of the rally if it was bigger position but - when the opportunity is there, act.

Future reference - pay more attention to your notes & less attention to price moves & specifically price anchors, jitters notwithstanding.

Moneysupermarket did a lot of heavy lifting - quite the re-rating & since this was purchased as a value / rerate thesis, it is near sale territory. That said, the momentum is strong, which I am inclined to follow for now especially as the earnings picture improves - probably why the momentum has improved!

On the losers,

BATs soft warning & buyback cancellation,

SPT warning (did say about Calnex that telecoms was worse performing sector in 2022) - stupid relative value trade - sold in July - need to practice taking losses + better alternatives.

I might regret this one, although if you glanced at what Nokia & Ericsson had to say, maybe not!

DLG - What a pile of cr4p - sold in July - need to practice taking losses + better alternatives. I get the feeling I am going to watch this dumpster fire rally & think, that could have been me!

EMIS merger arbitrage didn't work so now I am a long term holder - very expensive in context of market or is FV closer to £19?

Top 5 at the start of the year

Bloomsbury - down 3% - I have reduced my holding by about 30%. No reason for reduction other than the size of the holding was giving me jitters. Unfortunately, I did this not when I felt the size was giving me jitters but after the share price fell 10% & jitters were realised.

For future reference, I must sell at implied jitters in stead of realised jitters

Bioventix - down 3% - I actually sold in early Jan (my year end blog suggested it was at an artificially high mark due to influencers) & then I bought back - Yay me!

Subsequent to half year, I sold the piece bought back - remarkable company but circle of competence & pretty sure my buy back was a function of don't just sit there, do something. July is probably the same, but this something makes more sense!

Tate & Lyle - up 2% - no change here - still doing its thing turning into a quality compounder with decent growth - trading at a substantial discount to similar companies (chemical / solutions vs Sugar) - happy holder & pretty sure it is my biggest position. I am pretty comfortable with it but then there might be some report about Aspartame causing cancer (apart from the dosage provided by Pepsi/Coke), but for now sucralose should be a beneficiary.

Volvere - up 1.3% - Mild reduction for tax reasons - surely this is their time - I am surprised they haven't moved on anything. In the mean time, value! Being more recent to the shareholder register, I am afraid I don't quite have the same faith as others in mgt (yet) but cutting losses at indulgence for turnaround specialists indicated capital allocation skill & self awareness.

British American Tobacco - down 20.5% - and approximately 0.6% cost to the portfolio.

As I said in my 2022 review, if I was the same person/investor I am today, I would not have bought it.

Side note: One of my more notable achievements in 2023 is that I quit smoking (28 December 2022 to be precise & one slip in early June), so now I too am on the ethical high horse.

I knew I didn't want to quit smoking lest I become one of those "non-smokers" so I would like to remind myself - Non-smokers die every day!

Back to finance, quantitatively it is cheaper than a pack of cigarettes in a price controlled emerged market - They cancelled the buyback and have a terrible balance sheet - refinances in the 7% area - that debt is looking interesting too no? Think there is one more due this year, then refinancing risk should be dealt with.

If I was CFO turned CEO, I'd cull dividend, use half to pay debt/half to buy back & then bring back the dividend next year, but that is probably why I'll never be a CFO or CEO!

Top 5 at 30th June

iShares UK GILTS, iShares US Treasury, iShares Sterling Gold -

While the market was busy yoloing on ZDTE options on artificially inflated stocks, I was yoloing my life savings on short dated government paper - timing could not have been worse (well it could, I could have bought this time in 2021) because it was a day before May inflation but then June was good & if you like June, you should wait to see July.

As for gold - I'm a gold bug - held in $, sold for tax reasons & replaced £ - stupid but wasn't a currency trade - decided to yolo my $ into short dated US treasuries.

More on this on musings but now 20% is here - effectively cash is now near zero - so a hurdle rate for equities or is it permanent decision to keep 20% in bonds.

SUS - I doubled my holding here in February & it worked quite well, especially when dividends are added. Compared to other mainstream lending institutions, I think this oozes quality. Also, I think as credit tightens, alternative lenders have a market share opportunity.

Disclosure: I reduced this in July, still top 5 on individual securities but just the slave to macro & got to ~1.3x book with the size made me jittery & I'd rather not realise those jitters when down 20%

Future reference still applies, but a little less

BMY & TATE - As above - were the biggest & largely flat over period so remain - BMY smaller size / weight due to sales

Hargreaves Lansdowne - Added early May 2023 - I have said on more than one occasion, if there was one company I'd be willing to put 100% of my net worth into, it would be this and I figured the portfolio should at least sort of resemble this view. I made the above comments at Mello 2022, thankfully at Mello 2023 Graham Neary & Bruce Packard had my back.

BVXP - As above - high due to add back - subsequently reversed.

Musings

This is a strange one but I wanted to go back to one of my comments from 2022 review - this is the first time I felt scared - I don't think that was accurate - I was constrained because of moving house but the looking back, I think the real reason I was deer in headlights was not fear, but actually an abundance of opportunity.

I think my time investing has been a low return environment - the number of stocks that met my required return / risk were quite limited & the job was as a result easier - not dissimilar to preferring the two state world where there were no alternatives. The valuations for quality / growth quite often egrigious & value stocks offering returns that did not represent value.

I dare say one of the reasons value did so cr4p for a decade or more wasn't falling rates/QE (especially if H1 2023 is anything to go by), but rather value investors bought cheap things and the only things that were cheap were cheap for a reason.

Today, not so - I can give you any number of sectors where you can buy high quality businesses going into a downturn at mid single digit multiples, discounts to book value all over the place & quality compounders at low teen multiples.

I was/am cautious & I think that caution has stood me in good stead - Modified Dietz from 10 June 2021 all time performance high to 30th June is -8%. Nothing to write home about, but it does beat risk free bonds by a long way!

The more I think about it, I think my portfolio construction was a function of the environment I was operating in, whereas now as the risk adjusted return of buying a sh1tco improves, maybe the investment approach also needs to evolve.

Paraphrasing the immortal words attributed to Keynes, when the facts change I change my portfolio.

Another thing that I have been trying to do is reduce the number of holdings, but then as I say there are a lot more opportunities around - similar to 2020 & the volatility at times is just gut wrenching. Being a buy and hold, long term business owner approach - morally superior as it is - I am not sure is sensible.

Especially when you are holding stocks where the price is falling and you are choosing to sit in the car as it drives off a cliff (Somero comes to mind) & I am pretty sure Sanderson will come to mind!

I understand one of the big advantages we PIs have is the lack of size, or at least that is what underperforming portfolio managers tell us.

In this environment, I think infinite capital would be easier - there are so many results where I see a clear buy in spite of the business / sector / competence - infinite capital would reduce the portfolio turnover!

If I am honest with myself, I think this challenge is a function of the fact that I don't have a style that I am able / willing to stick to.

The key factor is quality across the board with momentum & value more haphazard.

The defensive / cautious approach served me well in a low return environment, it makes sense to be more aggressive / accept mor risk given higher potential returns

Relax the number of holdings / sizing requirements given opportunity and uncertainty.

There can be a place for speculative growth / deep value / micro caps - historically I used to run multiple portfolios - I dare say these more aggressive types - can collectively be considered a single holding in a portfolio - although how this reconciles with what you are going to say about time allocation is beyond me.

The other issue - as the number of investable opportunities increases, time becomes a serious constraint & I am not sure a beach bumming digital nomad reconciles with time constraints.

Again, being distracted by too many opportunities & generally being distracted is due to an ill defined investment style & flaws in personality but I think I need to consider time allocation as much as capital allocation.

Macro - I was wondering why I and others were so wrong on the macro.

Well firstly, macro is hard.

Secondly, I remember in June last year looking at results thinking - wow - I have not see business fall of a cliff like this before - that wasn't cost of living but a business/sector cycle on steroids.

I think I tend a little bearish.

On the macro front, I actually had a reasonable hit rate but my assessment of the markets expression of those macro events was way off.

But with valuations where they are now (in UK), I don't think you need any great macro insight, so long as you believe that we will still have houses to live in, wear clothes & eat out once in a while.

Of course, if I believe all these things, should I be holding short dated bonds - effectively what I am saying is that there will be a bout of disinflation (transitory by the way) - so bonds will rally while I can buy some small caps with my bond sale proceeds/income.

Placing a great deal of faith in my being right on several fronts, not least timing!

Or have I made an asset allocation decision - what was cash is now bonds. I did have a portion of bonds that I moved to cash because of zero return. That is now back to bonds.

I am very curious to see how all this evolves over the course of H2 - July 23 already has 8 transactions versus 24 in the previous 6 months.

Narratives

Whether I am a contrarian investor or not, I am a contrarian person so, I thought I would clarify some oddities.

Market is being led higher by 7 stocks - they account for 65% (or whatever) of the S&P return. Does that not mean the remaining 493 did 5% in 6 months into a rising rate environment & economic recession? If Carlsberg did bear market rallies!!

My random list of US companies - probably more speculative end - out of 130 stocks, 94 are up & 81 are up more than 5%

Market is being led by 7 stocks or do they mean 7 indices?

We were going to hell in March - SVB failed, banks were never going to lend again & another financial crisis is coming, until Artificial Intelligence came along to save us.

The common thread in all of this from what I can tell, narrative follows price!

FWIW, as much as I am coloured bearish, I did say I need to pay more attention to momentum (respect the efficiency of the market as it were), it is hard to see this price action and conclude that we are not in a bull market.

I see tech seems to be slowing down, while industrials, financials, oil - value sectors gather steam - as long as the magnificent 7 consolidate YTD gains, why should the index fall.

And if we are going into a balance sheet recession with all the deleveraging thar requires, well the 7 stocks that can offer growth in a depression - I'd like some of those Apples & Chips!

As for UK (& Hong Kong I hear), it is so cheap, even boring index tracking PI like me is thinking, hmm - these opportunities are compelling.

Maybe that China re-opening narrative will turn into China re-stimulating narrative - especially if the materials/energy stocks get a run going (it does seem to have started - June was good for cyclicals / small caps.

On the other hand, I am a permabear.

Some of the super star financiers at banks & pension funds have not been able to handle the rising rate environment, what chance us mere mortals?

If we are struggling, then surely we are entitled to ask - Where's my bailout? - not forthcoming because of inflation but then,

Surely we demand - Oi, Jezza, Rishi - Seriously, where is my bailout - you have an election coming!

At least with Liz Truss, I would have a lower tax bill to pay my 6% mortgage & you didn't stop the boats!

So inflation might be transitory, disinflation might be transitory, the narrative will be transitory.

And Finally,

I think I ended my 2022 review with a story about my phone falling out of a moped and it being handed in & with luck like that, how could 2023 be anything other than positive.

Got something right - as I say, better to be lucky than smart!

Well, a few weeks later, my wife lost her phone & the owners of the hotel where we lost it drove an hour out of their way to drop it of to us.

Silver Cliff in Khao Sok, Thailand if you ever find yourself in the area!

I have no doubt Artificial Intelligence like all our amazing achievements that came before will enrich our lives.

So will genuine kindness!

Adieu

Transactions for those that are interested

Jan 23: Reduce Bioventix - Influencer mark

Jan 23: Sell Blackrock - Served its purpose as a high beta play & didn't want to carry into results

Feb 23: Sell Barratts - Felt the rally went too far too fast

Feb 23: Add SUS - 10-15% RoE trading at tangible book, re-rate potential 1.5-2x on higher TBV

Feb 23: Buy CML - Liked it but price anchoring. ST tip triggered last chance salon feeling. Execution error for sure, investment error, time will tell.

Future reference: Price anchoring & if acting on a tip, wait 24hrs - also ST tipped something you liked, not first time - maybe have some faith.

Feb 23: Buy Paypoint - Already had starter through Appreciate merger arb, making full size

Feb 23: Sell Microsoft - Capacity issues, couldn't review results (more below) & thought we would see the multiple contract

Feb 23: Buy IBTS - Proceeds of MSFT - 2 yr treasury yield was higher than MSFT earnings yield & I expected latter to expand & the former to contract - So, So, Early - AKA WRONG!

Feb 23: Sell Liontrust - Said in my blog it wouldn't stay long (still wonder why it came back), high beta purpose served

Feb 23: Buy Supermarket Income - Liontrsut proceeds - Felt they were overdone & offered attractive returns. Pretty much nailed the forward NAV, most definitely did not nail that discount to book value widening!

Feb 23: Sell CLX (small piece retained) - Spirent warning would hit Calnex, too expensive to carry into warning.

Mar 23: Appreicate sale - Acquisition completed

Apr 23: Sell Volvere - tax

Apr 23: Buy SGLN - proceeds from sale of GLD - tax

Apr 23: Buy Money market fund - Cash balance to money market fund

May 23: Add Hargreaves Lansdowne - Position size should reflect my perceived confidence

May 23: Buy Volvere - 30 days post sale

May 23: Add BVXP - felt compelled to do something, maybe FOMO - was wrong & since reversed

May 23: Buy IGLS - Cash held to bonds - if you think HL & AJ Bell are ripping you on cash held in your stocks & shares ISA, try IG Group!! Long duration would have been better - macro is hard!!

May 23: Buy Liontrust - Oh so cheap - surely someone will take them out of their misery.

Jun 23: Reduce BMY - Position size was giving me jitters, especially if price went down!

Jun 23: Buy Time - monitor pre results - think there is something potentially interesting - small & illiquid - not sure as minute holding - illiquid!

Jun 23: Add CML - Again stupid - read results, reached conclusion, then ST coverage made me change my view for no reason - since reversed.

Jun 23: Sell Tesco - portfolio reasons - first manifestation of less caution / more aggression

Jun 23: Buy UPGS - Tesco proceeds - first manifestation of less caution / more aggression.

Comments

Post a Comment